Pegasystems PEGACPDC88V1 Exam Questions

Questions for the PEGACPDC88V1 were updated on : Feb 18 ,2026

Page 1 out of 4. Viewing questions 1-15 out of 60

Question 1

MyCo, a telecom company, notices that when customers call to check on bill status, 80% of the time,

they received the wrong offer promotion, leading to customer dissatisfaction. The company decides

to boost customers' needs in the prioritization formula, to improve sales in the current quarter.

Which arbitration factor do you configure to implement the requirement?

- A. Context weighting

- B. Business weighting

- C. Propensity

- D. Business value

Answer:

C

Explanation:

The arbitration factor is a parameter that allows you to adjust the weight of each factor in the

prioritization expression, based on your business strategy and preferences. The arbitration factor is

multiplied by the factor value to calculate the final priority score of each offer for each customer. If

you want to boost customers’ needs in the prioritization formula, you can increase the arbitration

factor for the propensity, which is the factor that reflects the predicted customer behavior. The

higher the arbitration factor for the propensity, the more influence it has on the priority score,

making the offers that match customers’ needs more likely to be selected and presented to the

customer. Verified Reference: [Pega Decisioning Consultant | Pega Academy]

Question 2

You are the decisioning architect on an Al-powered one-to-one customer engagement

implementation project. You are asked to design the next-best-action prioritization expression that

balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

- A. Predicted customer behavior

- B. Offer eligibility

- C. Customer contact policy

- D. Offer relevancy

Answer:

A

Explanation:

The prioritization expression is a formula that calculates the priority score of each offer for each

customer, based on various factors that reflect the customer needs and the business objectives. One

of the most important factors is the predicted customer behavior, which is measured by the

propensity. The propensity is a value that indicates how likely a customer is to accept an offer, based

on their attributes and behaviors. The propensity is calculated by using predictive analytics models

that learn from historical data and feedback. The higher the propensity, the higher the priority score,

making the offer more relevant and valuable for the customer. Verified Reference: [Pega Decisioning

Consultant | Pega Academy]

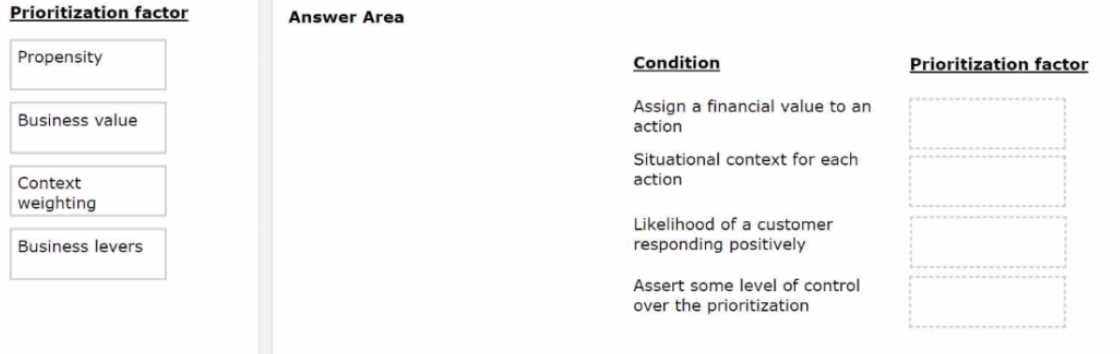

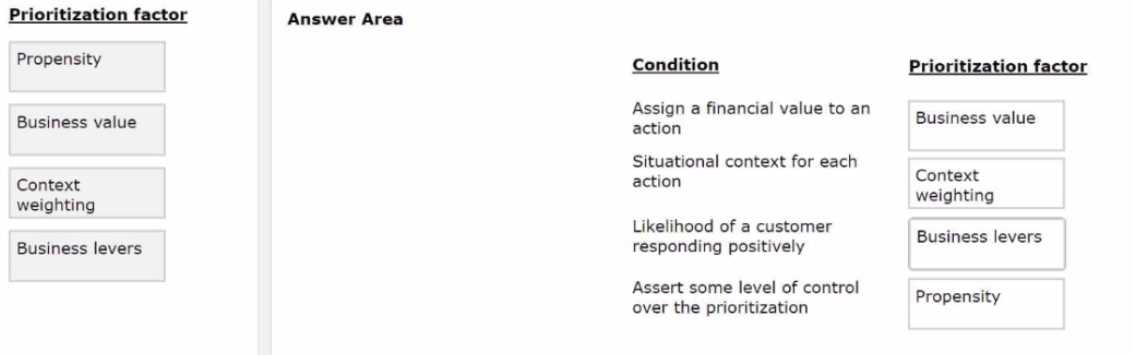

Question 3

DRAG DROP

You are a decisioning architect responsible for configuring offer prioritization for home loan offers

based on the business requirements. Select each prioritization factor on the left and drag it to the

correct condition on the right.

Answer:

None

Explanation:

Question 4

MyCo, a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its

premium customers. As the bank has financial targets to meet, the business decides to boost the

MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFone 14 Pro offer is prioritized over other

offers?

- A. Increase the business weight of the MyFone 14 Pro offer.

- B. Increase the starting propensity of the MyFone 14 Pro offer.

- C. Increase the context weight of the MyFone 14 Pro offer.

- D. Increase the business value of the MyFone 14 Pro offer.

Answer:

A

Explanation:

The business weight is a parameter that allows you to manually adjust the priority of an offer based

on your business objectives and preferences. The business weight is multiplied by the business value

and the propensity to calculate the final priority score of an offer. A higher business weight means a

higher priority score, making the offer more likely to be selected and presented to the customer.

Therefore, if you want to boost an offer, you can increase its business weight. Verified

Reference:

Pega Decisioning Consultant | Pega Academy

Question 5

U+ Bank presents various credit card offers to its customers on its website. The bank uses AI to

prioritize the offers according to customer behavior. With the introduction of the Gold credit card

offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

- A. Similar customers do not qualify for the offer.

- B. Similar customers show interest in the offer.

- C. Similar customers purchase other offers.

- D. Similar customers ignore the offer.

Answer:

D

Explanation:

The propensity is a measure of how likely a customer is to accept an offer, based on their attributes

and behaviors. The propensity is calculated by using predictive analytics models that learn from

historical data and feedback. A low propensity value indicates that the offer is not relevant or

attractive for the customer, and that similar customers have ignored or rejected the offer in the past.

Therefore, if the offer click-through propensity decreased to 0.42, it most likely indicates that similar

customers ignore the offer. Verified Reference:

Pega Decisioning Consultant | Pega Academy

Question 6

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The

bank observes that as customers progress through the journey, one customer entered the third stage

of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

- A. The bank implemented upweighting for the third stage.

- B. The customer was not eligible for the last stage of the journey and the system presented an offer outside the journey.

- C. The customer can be involved in only one active journey at a given moment.

- D. The customer always receives the most relevant action, even if an action is not a part of any journey.

Answer:

D

Explanation:

Pega Customer Decision Hub always selects and prioritizes the most relevant and valuable action for

each customer at any given moment, regardless of whether the action is part of a journey or not. A

journey is a way to group and organize actions that are related to a common business objective or

customer need, but it does not override the Next-Best-Action strategy that determines the best

action for each customer. Therefore, if a customer receives an offer that is not included in any

journey, it means that the offer is more suitable and beneficial for the customer than any other offer

in the journey. Verified Reference:

Pega Decisioning Consultant | Pega Academy

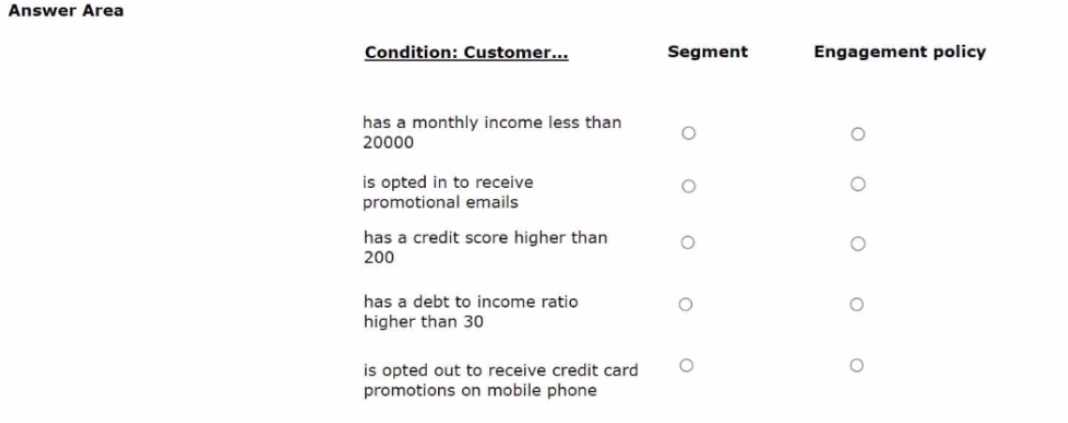

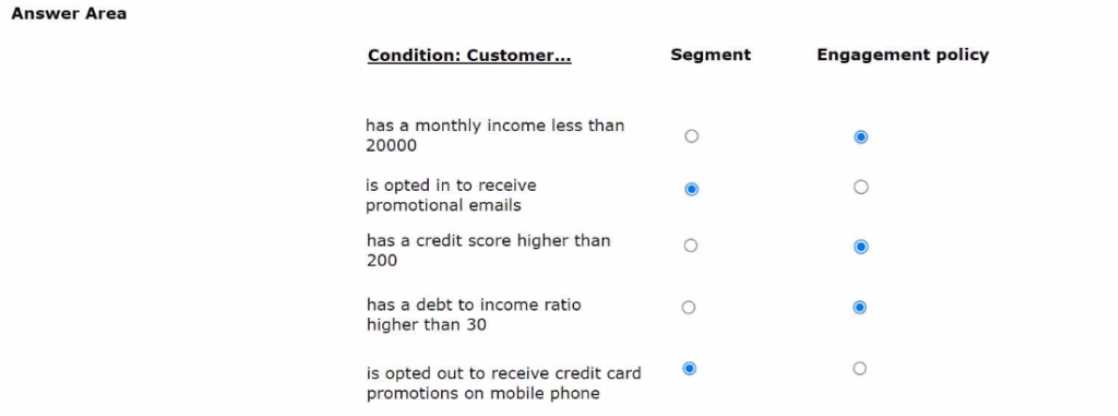

Question 7

HOTSPOT

U+ Bank's marketing department wants to use the always-on outbound approach to send

promotional emails about credit card offers to qualified customers. As a part of this promotion, the

bank wants to identify the starting population by defining a few high-level criteria in a segment.

For each condition below, select which two conditions should be defined in Segment and which three

conditions should be defined in Engagement policy as best practice.

Answer:

None

Explanation:

Question 8

Pega Customer Decision Hub enables organizations to make Next-Best decisions. To which type of a

decision is Next-Best-Action applied?

- A. Determining if a borrower gets a loan

- B. Determining how to optimize inventories

- C. Predicting the time of a machine failure

- D. Optimizing supply chain management

Answer:

A

Explanation:

Next-Best-Action is a type of decision that involves selecting and prioritizing the most appropriate

proposition for each customer at any given moment. Next-Best-Action can be applied to decisions

that require customer-centricity, personalization, and contextualization. Determining if a borrower

gets a loan is an example of such a decision, as it depends on the customer’s attributes, behaviors,

preferences, and needs. The other options are examples of decisions that are not related to customer

interactions, but rather to operational or analytical processes. Verified Reference: [Pega Decisioning

Consultant | Pega Academy]

Question 9

As a Customer Service Representative, you present an offer to a customer who called to learn more

about a new product. The customer rejects the offer. What is the next step that Pega Customer

Decision Hub takes?

- A. Stops presenting offers to the customer

- B. Adds the customer to the potential churn list

- C. Reevaluates the Next-Best-Action

- D. Sends a detailed email about the offer

Answer:

C

Explanation:

Pega Customer Decision Hub is a dynamic and adaptive system that constantly reevaluates the Next-

Best-Action for each customer based on their interactions and feedback. If a customer rejects an

offer, the system will update the customer profile and the offer performance, and then reapply the

Next-Best-Action strategy to select and prioritize another offer that is more relevant and valuable for

the customer. Verified Reference: [Pega Decisioning Consultant | Pega Academy]

Question 10

As a decisioning architect, you advise the board on the business issues for which they must use the

Next-Best-Action strategy. Which three business issues do you recommend? (Choose Three)

- A. Resource Planning

- B. Service

- C. Retention

- D. Collections

- E. Accounting

Answer:

B, C, D

Explanation:

The Next-Best-Action strategy is a customer-centric approach that aims to deliver the most relevant

and valuable proposition for each customer at any given moment. You can use the Next-Best-Action

strategy to address various business issues that involve customer interactions, such as service,

retention, and collections. Service is the process of providing assistance and support to customers

who have questions or problems. Retention is the process of preventing customers from leaving or

switching to competitors. Collections is the process of recovering unpaid debts from customers who

are delinquent or defaulting on their obligations. These are all business issues that can benefit from

using the Next-Best-Action strategy. Verified Reference: [Pega Decisioning Consultant | Pega

Academy]

Question 11

U+ Bank is facing an unforeseen technical issue with its customer care system. As a result, the bank

wants to share the new temporary contact details with all customers over an SMS.

Which type of outbound interaction do you configure to implement this requirement?

- A. Scheduled update

- B. Security event

- C. Customer event

- D. Priority communication

Answer:

D

Explanation:

A priority communication is a type of outbound interaction that allows you to send urgent messages

to customers that are not related to any specific offer or proposition. You can use priority

communications to inform customers about important events or changes that affect their

relationship with your organization. In this case, the bank wants to share the new temporary contact

details with all customers over an SMS, so creating a priority communication is the best option.

Verified Reference: [Pega Decisioning Consultant | Pega Academy]

Question 12

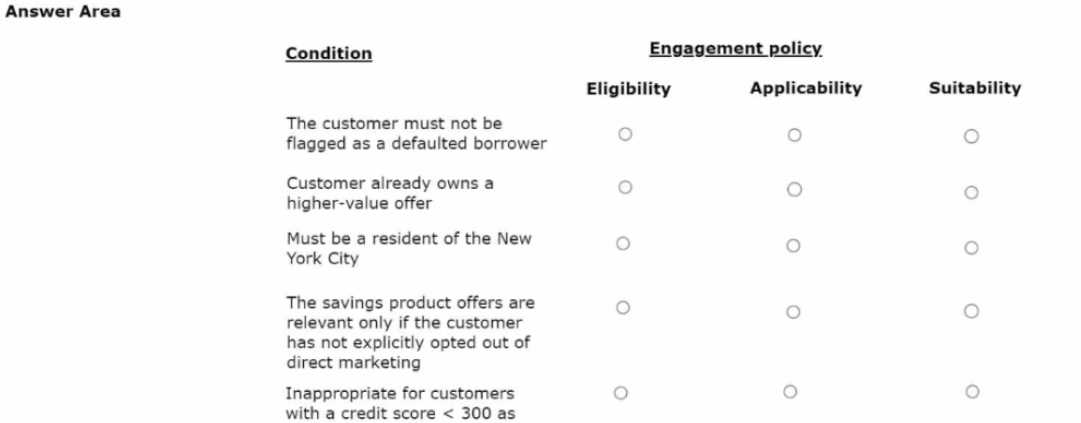

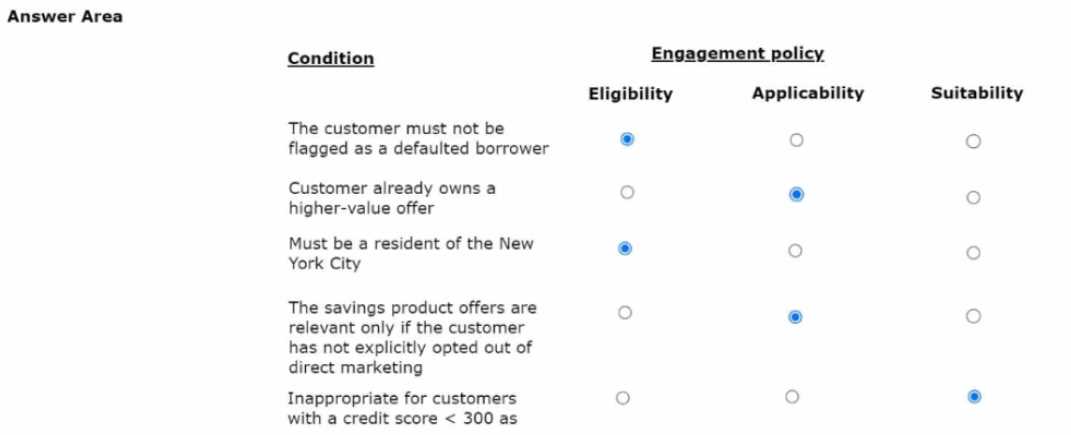

HOTSPOT

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented

to qualified customers when they log in to the web self-service portal. The bank added engagement

policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

Answer:

None

Explanation:

Question 13

U+ Bank wants to offer a Gold credit card to customers who have an annual income of more than

USD150000. What do you configure in the Next-Best-Action Designer to achieve this outcome7

- A. Engagement policy condition

- B. Audience

- C. Customer segment

- D. Prioritization formula

Answer:

A

Explanation:

An engagement policy condition is a rule that determines whether a customer is eligible, applicable,

or suitable for an offer. You can use engagement policy conditions to filter customers based on their

attributes or behaviors. In this case, the bank wants to offer a Gold credit card to customers who

have an annual income of more than USD150000, so creating an engagement policy condition based

on the income attribute is the best option. Verified Reference: [Pega Decisioning Consultant | Pega

Academy]

Question 14

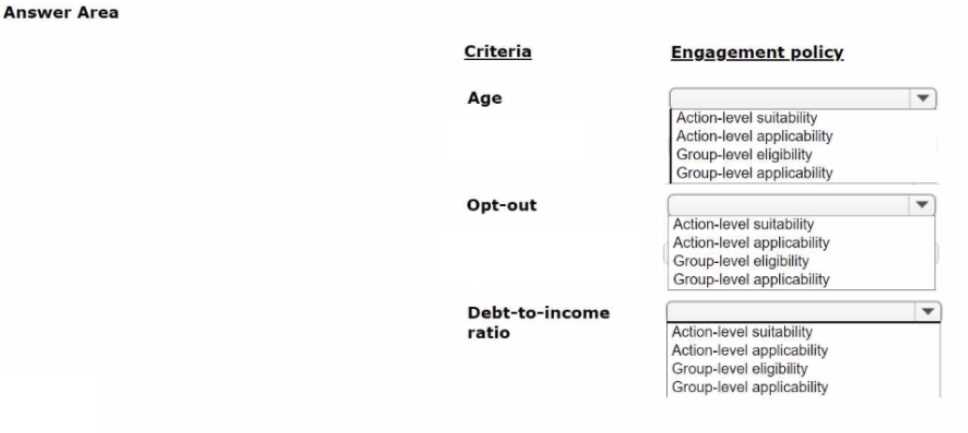

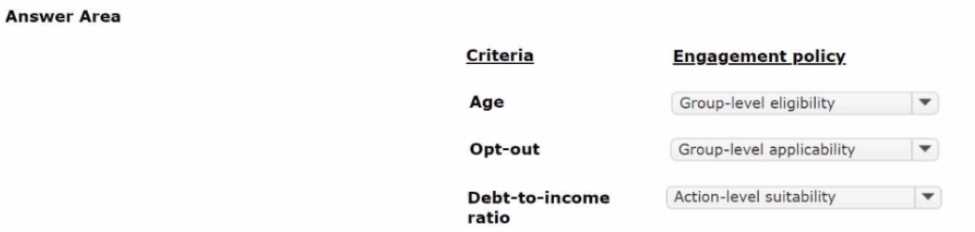

HOTSPOT

U+ Bank decides to introduce a credit cards group by leveraging the Next-Best-Action capability of

Pega Customer Decision Hub™. The bank wants to present the credit card offers through inbound and

outbound channels based on the following criteria:

1. Customers must be above the age of 18 to qualify for credit card offers.

2. The site offers credit cards only if customers do not explicitly opt-out of any direct marketing for

credit cards.

3. The Platinum Card, one of the credit card offers, is suitable for customers with debt-to-income

ratio < 45.

As a decisioning architect, how do you implement this requirement? In the Answer Area, select the

correct engagement policy for each criterion.

Answer:

None

Explanation:

Question 15

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the

country. They want to advertise this offer on their website by using a banner, targeting the customers

who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?

- A. A customer segment

- B. An audience

- C. A prioritization formula

- D. Applicability rules

Answer:

B

Explanation:

An audience is a group of customers who share common characteristics or behaviors that are

relevant for a business objective. You can use audiences to target specific customers with specific

offers or treatments. In this case, the bank wants to advertise a new mortgage refinance offer to the

customers who live in the eastern region of the country, so creating an audience based on the

location attribute is the best option. Verified Reference: [Pega Decisioning Consultant | Pega

Academy]