microsoft MB-310 Exam Questions

Questions for the MB-310 were updated on : Jun 28 ,2025

Page 1 out of 14. Viewing questions 1-15 out of 198

Question 1 Topic 1, Case Study 1Case Study Question View Case

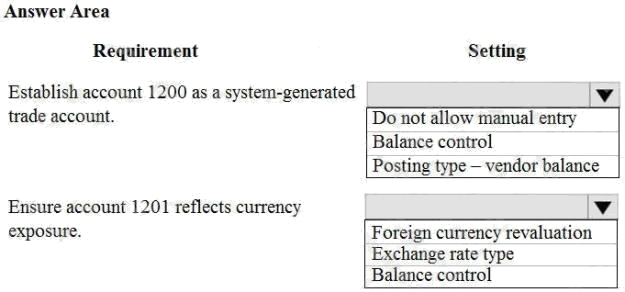

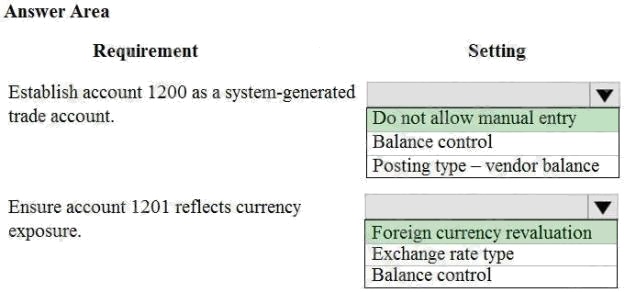

HOTSPOT

You need to configure settings to resolve User1s issue.

Which settings should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Question 2 Topic 1, Case Study 1Case Study Question View Case

You need to correct the sales tax setup to resolve User5's issue.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

- A. Populate the sales tax code on the sales order line.

- B. Assign the sales tax group to CustomerY.

- C. Assign the relevant sales tax code to both the sales tax and item sales tax groups.

- D. Populate the item sales tax group field on the sales order line.

- E. Populate the sales tax group field on the sales order line.

Answer:

C D E

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview

Question 3 Topic 1, Case Study 1Case Study Question View Case

You need to troubleshoot the reporting issue for User7.

Why are some transactions being excluded?

- A. User7 is running the report in CompanyB.

- B. User7 is running the report in CompanyA.

- C. The report is correctly excluding CustomerY transactions.

- D. The report is correctly excluding CustomerZ transactions.

Answer:

C

Question 4 Topic 1, Case Study 1Case Study Question View Case

You need to configure settings to resolve User8s issue.

What should you select?

- A. a main account in the sales tax payable field

- B. a main account in the settlement account field

- C. the Conditional sales tax checkbox

- D. the Standard sales tax checkbox

Answer:

B

Question 5 Topic 1, Case Study 1Case Study Question View Case

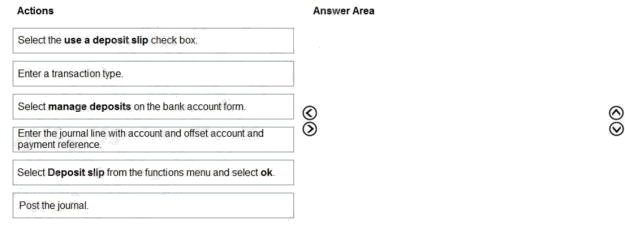

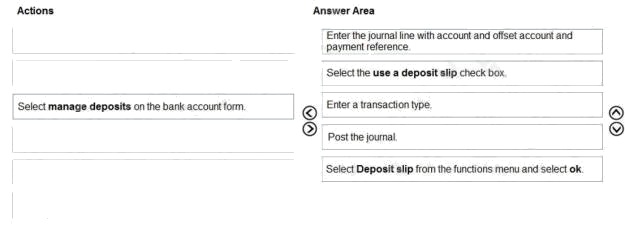

DRAG DROP

You need to assist User3 with generating a deposit slip to meet Fourth Coffee's requirement.

Which five actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the

answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

Select and Place:

Answer:

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/create-a-deposit-slip

Question 6 Topic 1, Case Study 1Case Study Question View Case

You need to view the results of Fourth Coffee Holding Company's consolidation.

Which three places show the results of financial consolidation? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

- A. a financial report run against the company Fourth Coffee

- B. a trial balance in the Fourth Coffee Holding Company

- C. a trial balance in the company Fourth Coffee

- D. a financial report run against the Fourth Coffee Holding Company

- E. the consolidations form in Fourth Coffee Holding Company

Answer:

B D E

Question 7 Topic 1, Case Study 1Case Study Question View Case

You need to configure the system to resolve User8's issue.

What should you select?

- A. the Standard sales tax checkbox

- B. the Conditional sales tax checkbox

- C. a main account in the settlement account field

- D. a main account in the sales tax payable field

Answer:

C

Question 8 Topic 2, Case Study 2Case Study Question View Case

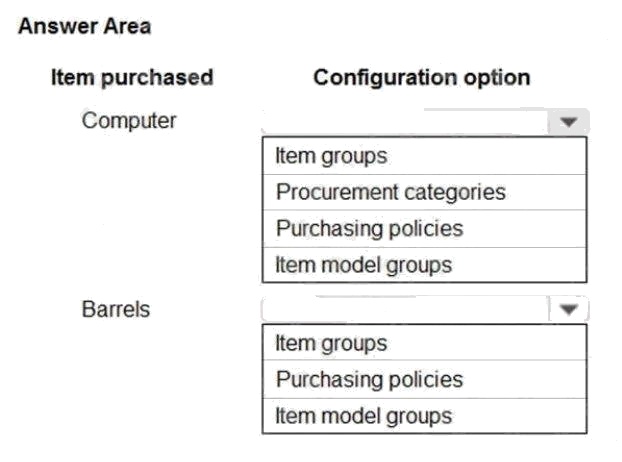

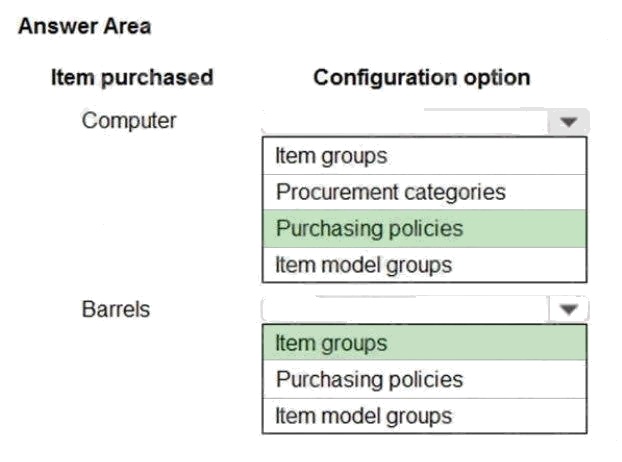

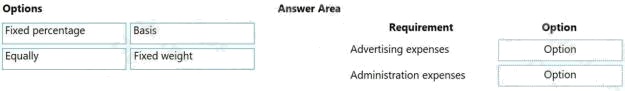

HOTSPOT

You need to determine the root cause for User1s issue.

Which configuration options should you check? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Question 9 Topic 2, Case Study 2Case Study Question View Case

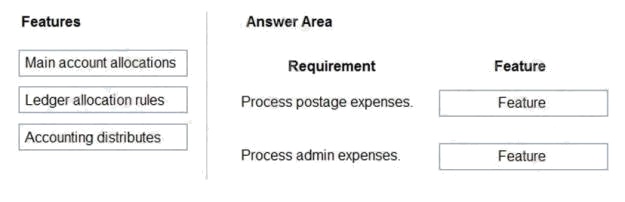

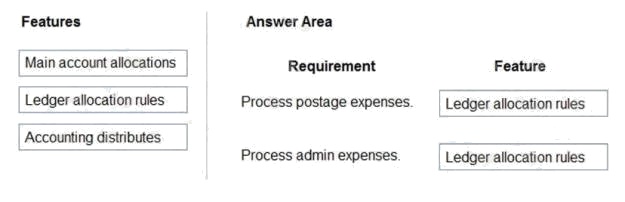

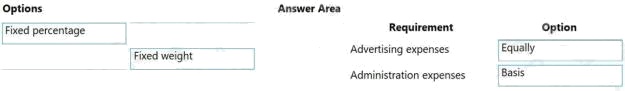

DRAG DROP

You need to process expense allocations.

Which features should you use? To answer, drag the appropriate features to the correct requirements. Each feature may be

used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Explanation:

Reference: https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/ledger-allocation-rules

Question 10 Topic 2, Case Study 2Case Study Question View Case

You need to configure system functionality for pickle type reporting.

What should you use?

- A. item model groups

- B. item groups

- C. procurement category hierarchies

- D. financial dimensions

- E. procurement categories

Answer:

B

Question 11 Topic 3, Case Study 3Case Study Question View Case

The Canadian franchise purchases excess ski equipment from the US franchise. Two sets of skis are purchased totaling

USD1,000.

When the purchase invoice is prepared, USD10,000 is keyed in by mistake.

Which configuration determines the result for this intercompany trade scenario?

- A. Post invoices with discrepancies is set to require approval.

- B. Match invoice totals is set to yes.

- C. Three-way match policy is configured.

- D. Two-way match policy is configured.

- E. Post invoices with discrepancies is set to allow with warning.

Answer:

C

Question 12 Topic 3, Case Study 3Case Study Question View Case

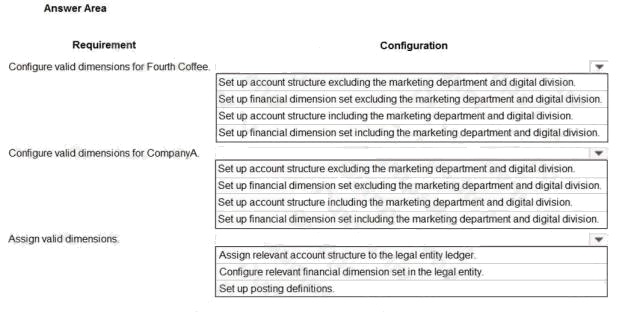

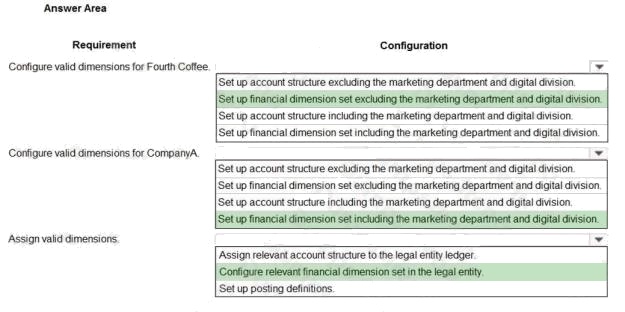

DRAG DROP

You need to configure ledger allocations to meet the requirements.

What should you configure? To answer, drag the appropriate setups to the correct requirements. Each setup may be used

once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Explanation:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/ledger-allocation-rules

Manage and apply common processes

Question 13 Topic 3, Case Study 3Case Study Question View Case

You need to adjust the sales tax configuration to resolve the issue for User3.

What should you do?

- A. Create multiple settlement periods and assign them to the US tax vendor.

- B. Create multiple sales tax remittance vendors and assign them to the settlement period.

- C. Run the payment proposal to generate the sales tax liability payments.

- D. Create a state-specific settlement period and assign the US tax vendor to the settlement period.

Answer:

D

Question 14 Topic 4, Case Study 4Case Study Question View Case

You need to determine why CustomerX is unable to confirm another sales order.

What are two possible reasons? Each answer is a complete solution.

NOTE: Each correct selection is worth one point.

- A. The credit limit parameter is set to Balance + All.

- B. The credit limit is set to 0.

- C. An inventory item is out of stock.

- D. The inventory safety stock is set to 0.

Answer:

A C

Question 15 Topic 4, Case Study 4Case Study Question View Case

HOTSPOT

You need to prevent a reoccurrence of User2s issue.

How should you configure the system? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Explanation:

0CB84EF020870C137158A568970423A4 Implement and manage accounts payable and receivable