ifse CIFC Exam Questions

Questions for the CIFC were updated on : Feb 20 ,2026

Page 1 out of 15. Viewing questions 1-15 out of 224

Question 1

Which of the following statements about standard deviation is CORRECT?

- A. Indicates how much an investment's performance fluctuates around its average historical return.

- B. A standard deviation greater than one indicates a higher level of volatility than the market.

- C. Measures the systematic risk of an investment relative to a benchmark index.

- D. Standard deviation is also referred to as beta.

Answer:

A

Question 2

Jacinta is a Dealing Representative with WealthSource Partners Inc., a mutual fund dealer registered

in Ontario. Jacinta meets with her friend Saabir, who is a licensed insurance agent. Saabir asks Jacinta

for

a list of Jacinta's clients so that Saabir can reach out to them to ensure that their insurance needs are

being met. Which of the following statements about Jacinta sharing the list with Saabir is CORRECT?

- A. If Saabir obtains prior consent from Jacinta to use the clients' personal information for a reasonable purpose, Saabir can contact the clients to inquire about their insurance needs.

- B. If Saabir promptly discloses that he has collected the clients' personal information from Jacinta without their consent, Saabir can use the information for a new stated purpose.

- C. If Jacinta determines that there is a reasonable purpose for sharing the list with Saabir, she can disclose the information to Saabir without obtaining prior consent from the clients.

- D. If Jacinta shares the list with Saabir without obtaining the clients' prior consent, she will be in breach of the Personal Information Protection and Electronic Documents Act (PIPEDA).

Answer:

D

Question 3

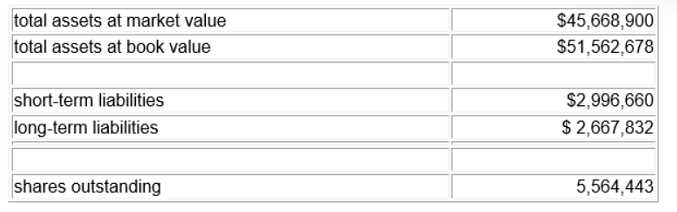

At 4:00 p.m. Eastern Time on July 6, the following information is collected for the Marigold Canadian

Dividend Fund:

What is the net asset value per unit NAVPU for the Marigold Canadian Dividend Fund for July 6?

- A. $7.19

- B. $7.65

- C. $8.25

- D. $9.27

Answer:

C

Question 4

Ayan wants to make a registered retirement savings plan (RRSP) contribution and deduct it from his

Year 1 income. What is the deadline for this contribution (assume that it is NOT a leap year)?

- A. March 1, Year 1

- B. March 1, Year 2

- C. December 31, Year 1

- D. December 31, Year 2

Answer:

B

Question 5

When comparing the current yield and yield-to-maturity of a bond, which statement applies?

- A. Yield-to-maturity accounts for the reinvestment of coupon payments.

- B. Yield-to-maturity is based on the current market value of the bond, not the price paid.

- C. Capital gains or capital losses are reflected in the current yield calculation.

- D. Current yield includes in the calculation the time to maturity.

Answer:

A

Question 6

Reagan has accepted a role to be the Chief Revenue Officer of a charitable organization. She is

currently registered as a Dealing Representative for Sunshine Financial Services.

Which of the following would apply to her?

- A. The dealer will closely monitor her sales activities to ensure any clients from the charity are not getting a discount on potential fees.

- B. Holding both positions at the same time is a violation of securities industry rules and regulations .

- C. Reagan is not required to inform her dealer of this outside activity if none of her colleagues from the charity become clients.

- D. The regulator will limit her from providing financial services to anyone associated with the charity.

Answer:

C

Question 7

You are meeting a new client, Steven, and you are trying to determine his level of understanding of

different investments. Which question would give you the most information regarding your client's

familiarity with investing?

- A. Do you want to minimize taxes from your investments?

- B. What rate of return do you expect from investing?

- C. Do you understand the relationship between risk and return?

- D. Do you have the resources to invest for the long-term?

Answer:

C

Question 8

What areas are addressed in the Client Relationship Model (CRM) regulation?

- A. relationship disclosure, client communications, and client reporting

- B. fraud prevention, relationship disclosure, and proper conduct

- C. client communications, regulatory reporting, and fraud prevention

- D. ethics, proper conduct, and client reporting

Answer:

A

Question 9

Which statement regarding the Fund Facts document is CORRECT?

- A. Before accepting an order from a client, a Dealing Representative is expected to provide and explain the Fund Facts document.

- B. The Fund Facts document must be delivered to the client, electronically or in writing, within 5 days of the transaction date.

- C. For leveraged accounts, the Fund Facts document is not required if the client has been provided with the Leverage Risk Disclosure document.

- D. The Fund Facts document must not contain performance data.

Answer:

A

Question 10

10 years ago, Felipe opened a registered retirement savings plan (RRSP) account and purchased a

mutual fund. The mutual fund purchased included a 7-year deferred sales charge (DSC). At the time

of making his investment, him and his Dealing Representative agreed that he had a 25-year growth

objective. Since Felipe knew that he was not planning to use his investment until he retired, he was

not

concerned about the DSC. Although the rate of return did vary from year-to-year, he never noticed

his mutual fund having a drop in value. This gave Felipe more confidence in the investment. As a

result, he has never made any changes to his investment.

What category of Know Your Client (KYC) information has been given?

- A. Financial circumstances

- B. Investment experience

- C. Risk profile

- D. Personal circumstances

Answer:

B

Question 11

Axis Wealth Management Inc. is a mutual fund dealer and member of the Mutual Fund Dealers

Association of Canada (MFDA).

Indrek is a Branch Manager for the Guelph Branch and he is responsible for conducting suitability

reviews in order to identify any unsuitable transactions or accounts. Which of the following

accounts/transactions would be unsuitable?

- A. Gilles has invested in various mutual funds using a leverage strategy recommended by his Dealing Representative. Gilles is 82, he is retired, he needs regular income, and his risk profile is "low".

- B. Hundolf holds the Fortune Small Cap Equity Fund. Hundolf is fully employed, he is saving for his retirement in 18 years, his investment objective is "growth", and his risk profile is "medium-high".

- C. Megara bought a principal protected note (PPN) with a 7-year maturity. Megara wants principal protection and has a long-term investment time horizon (10+ years).

- D. Ulani is saving for the final payment she will owe on her pre-construction condominium. Ulani has invested in the Harbour Money Market Fund because she is seeking "safety".

Answer:

A

Question 12

Evan owns retractable preferred shares of Ingram Corp. Which statement CORRECTLY describes a key

feature of Evan's shares?

- A. Gives Evan the option to convert the Ingram Corp preferred shares into a fixed number of common shares at a predetermined price within a specified period.

- B. Offers Evan the opportunity to receive additional dividends if Ingram Corp's profit exceeds a stated level.

- C. Entitles Evan to sell the shares back to Ingram Corp at a pre-determined price and time in the future.

- D. Allows Ingram Corp to buy back the preferred shares at a pre-determined price within a defined period.

Answer:

D

Question 13

Preston has been working for Thompson Industries for just over a year and has been part of

Thompson's deferred profit sharing plan (DPSP) program from his start date. Preston wants to know

more about

these types of plans.

What would you tell Preston about DPSPs?

- A. The employer is obliged to make DPSP contributions for an amount equal to employee contributions.

- B. Once the plan is set up, the employer is obliged to make plan contributions each year.

- C. DPSP contributions are tax-deductible to the employer.

- D. Investment growth within the plan is taxable each year.

Answer:

C

Question 14

Douglas, aged 73, won a lottery prize of $100,000 last week. Today he contacted Vincent, his Dealing

Representative, with instructions to contribute the winnings to his registered retirement income

fund (RRIF) account.

Which of the following statement about RRIF is CORRECT?

- A. Deposits to RRIFs cannot be withdrawn for 5 years.

- B. Deposits into RRIFs are not permitted.

- C. Deposits to a RRIF entitle Douglas to a tax deduction.

- D. Withdrawals from a non-qualifying RRIF are not taxable.

Answer:

B

Question 15

Which of the following are obligations on mutual fund dealing representatives imposed by The

Proceeds of Crime (Money Laundering) and Terrorist Financing Act?

- A. record-keeping of large transactions, account-related information, and other relevant records

- B. reporting all financial transactions to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

- C. enhancing public awareness of matters related to money laundering and terrorist financing

- D. confirming client identity each time before concluding any transaction

Answer:

A