csi CSC2 Exam Questions

Questions for the CSC2 were updated on : Feb 20 ,2026

Page 1 out of 13. Viewing questions 1-15 out of 185

Question 1

Kenji is ready to place a large trade in a European small-cap ETF, traded on the TSX. It is 10 a.m. in

Toronto, where Kenji is located. What trading tip can Kenji use to protect his trade from sudden price

movements?

- A. Place his trade by executing it in small portions at a time.

- B. Place his trade when a trading halt is issued for any underlying ETF holding.

- C. Place his trade close to the end of the TSX's regular trading hours.

- D. Place his trade by using a limit order.

Answer:

D

Question 2

What risk exists for an investor unable to readily exit a position in an alternative investment near

current prices?

- A. Default.

- B. Liquidity.

- C. Trading.

- D. Deal breakage.

Answer:

B

Question 3

What event would trigger an amendment of the account application while monitoring a portfolio?

- A. When a new market cycle is formed.

- B. When the advisor's views are influenced by a recent news headline.

- C. When a client's job situation has changed.

- D. The annual client meeting.

Answer:

C

Question 4

Melanie has RRSP contribution room of $17,500 for the current tax year. Her husband, Jack, has RRSP

contribution room of $5,000. What is the maximum tax-deductible contribution Melanie can make to

her RRSP and/or a spousal RRSP?

- A. $17,500.

- B. $20,000.

- C. $5,000.

- D. $22,500.

Answer:

A

Question 5

What document must be provided to an investor before they purchase a mutual fund?

- A. The annual information form.

- B. A simplified prospectus.

- C. A Fund Facts document.

- D. The annual audited statements.

Answer:

C

Question 6

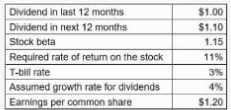

The following information is available for REW Co:

What is the price of REW Co. if calculated using the dividend discount model?

- A. $13.75.

- B. $15.71.

- C. $12.50.

- D. $14.29.

Answer:

D

Question 7

Why are inverse exchange-traded funds effective in declining markets?

- A. They use physical commodities.

- B. They use borrowed capital.

- C. They use active management.

- D. They use derivatives.

Answer:

D

Question 8

What is the bottom price of a security's trading range at which most investors would sense value and

be willing to buy it?

- A. Reversal pattern.

- B. Sentiment indicator.

- C. Support level.

- D. Moving average.

Answer:

C

Question 9

Which fee is paid to mutual fund sales representatives by the mutual fund manager?

- A. Redemption.

- B. Trailer.

- C. Operating.

- D. Management.

Answer:

B

Question 10

For a market capitalization-weighted ETF focused on the S&P/TSX Composite Index, what is likely the

greatest contributor to underperformance relative to the reference index?

- A. Liquidity.

- B. Fees.

- C. Rebalancing.

- D. Cash drag.

Answer:

D

Question 11

Supriya, an advisor, receives a research service from a dealer in exchange for placing securities

transactions with that dealer. What statement best applies to this type of arrangement?

- A. This arrangement is permissible if it benefits Supriya's firm.

- B. This arrangement can only be used for equity transactions.

- C. This arrangement needs to be disclosed to Supriya's clients.

- D. This arrangement violates best execution requirements.

Answer:

C

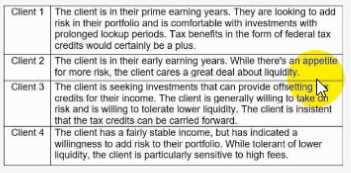

Question 12

An advisor wants to explain the benefits of labour sponsored funds (LSVCC) to some of his clients.

With which client should the advisor have this discussion?

- A. Client 1.

- B. Client 4.

- C. Client 2.

- D. Client 3.

Answer:

A

Question 13

During which step of the financial planning process should an engagement be formalized with a

professional service contract?

- A. Implement recommendations.

- B. Establish the client-advisor relationship.

- C. Recommend strategies to meet goals.

- D. Collect data and information.

Answer:

B

Question 14

For buy-side institutional investors, what is the purpose of algorithmic trading?

- A. To consolidate a large number of individual trades into a single trade to reduce the market impact.

- B. To optimize the order execution of small trades.

- C. To optimize the order execution of a large block of shares by breaking it up into smaller trades.

- D. To reduce overall trading order execution costs.

Answer:

C

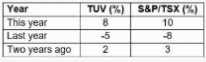

Question 15

The following table presents annual returns on TUV common stock and the S&P/TSX Composite Index

over a three-year period.

What is TUV's beta relative to the S&P/TSX Composite Index over this three-year period?

- A. Between 0 and 1.

- B. Greater than 1.

- C. Exactly 1.

- D. Less than 0.

Answer:

C