cima CIMAPRO19 CS3 1 Exam Questions

Questions for the CIMAPRO19 CS3 1 were updated on : Feb 20 ,2026

Page 1 out of 3. Viewing questions 1-15 out of 45

Question 1

SIMULATION

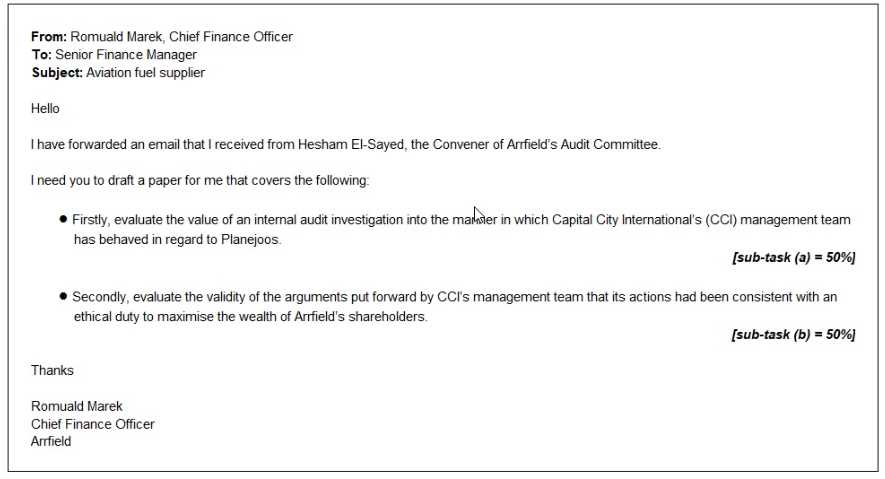

A month later, you receive the following email:

Reference Material:

From: Hesham El-Sayed. Independent Non-executive

Director

To: Romuald Marek. Chief Finance Officer

Subject: Collapse of fuel supplier

Hi Romuald

I am writing to give you some advance notice of an internal audit investigation that has been

commissioned by the Audit Committee

Just over a year ago. Planejoos, a newly formed company, approached the management team at

Airfield's Capital City International (CCI) airport and offered to take over refueling operations at

Starport Planejoos offered a higher percentage of revenue than the existing supplier was paying CCI's

management team agreed and appointed Planejoos rather than renew the existing supplier's

contract.

CCI was unable to conduct the usual background and credit checks on Planejoos for two reasons.

Firstly, Planejoos was a new company and so did not have an extensive credit history that could be

checked Secondly CCI was under time pressure to reach a decision on whether to renew the existing

supplier's contract or allow it to expire

CCI's management team claimed that it had acted quickly in order to benefit from the additional

revenue that could be earned from dealing with Planejoos The management team was acting on the

basis that it had an ethical duty to maximise the wealth of Airfield's shareholders and that

maximising revenues from fuel sales through this agreement with Planejoos was consistent with that

ethical duty.

Unfortunately, as a new company. Planejoos struggled to obtain trade credit and the high demand

for fuel put the company's cash flows under extreme pressure Receipts from sales lagged behind

payments for inventory Planejoos has now collapsed, leaving a large trade receivable that CCI will

have to write off as uncollectable CCI had permitted this receivable to accumulate rather

than pressing for payment and so putting Planejoos under further pressure.

Fortunately, the previous fuel supplier was prepared to return to CCI.

Kind regards

Answer:

See the

explanation below.

Explanation:

Requirement: 1

The acceptance of Planejoos at Capital City International airport with out credit rating check is a sign

of poor internal audit practices. The CCI is the biggest airport the Arrfied owned and amongst the

world big airports. The Planejoos is a newer and inexperienced company without sound credit and

financial history, the collapse of aviation fuel provider at a major airport is credit and reputaional risk

The internal audit performance laking in Arrfied which is in the aviation business could put the

business in danger and needs to be corrected. The poor performance of internal audit by not inusring

compliance could make damage i.e. a terrorist could attack the aircraft and landside if

properchecking are not done. The aviation business are vulnerable to hijacking, human trafficking

and smuggling. A special attention must be invited to internal audit.

The overall performance of the internal audit and audit committee is questionable here. The audit

committee is not formulated correctly. No non-executive director have sound financial expertise.

Martin Harris is the only NED with financial expertise and taking him out of audit committee is not

sign of good corporate governance. The new leadership at the audit committee with savvy of

financial knowledge must be on the board.

Martin Harris should be taken on the board in replacement of Carmelita Tante. Revamp the internal

audit department and startup a credit department which is also responsible to rating checking.

Arrfield must also think about to formulate a risk committee to check the risk and ensure that the

risks are properly managed.

Requirement : 2

It is the duty of the management to maximize the shareholder’s wealth, but a proper care must be

taken while making any decision on behalf of the shareholders. It seems due care is not given to the

decision and the decision was made in haste.

It is not only duty of the management to maximize wealth of the shareholder, they are supposed to

protect the wealth of the shareholders. Any decision no taken within the risk appetite of the

company may leads to breach of ethical principles.

The shareholders trust on the management that they will make the decisions in best interest of the

company even if this is not is their own interest. Incase of the Planejoos the management has

neglected the credit rating check any made the decision solely on the basis of prices that Planejoos

quoted. It seems that this decision does not fit in the risk appetite and risk tolerance of the Arrfield.

Question 2

SIMULATION

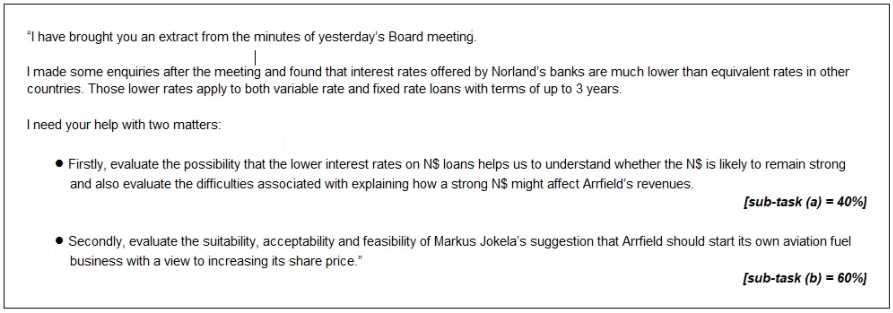

A week later, Romuald Marek stops by your workspace and hands you a document.

The Board minute extract from Romuald can be viewed by clicking the Reference Material button

above.

Reference Material

Board minutes extract: proposal to profit from ongoing strength of NS

Anna Obalowu Sole, Chief Operating Officer, reported that the strong NS was helping generate

revenues from fuel sales. Discussion followed as to whether the strong N$ was likely to persist and

whether a strong N$ benefits Arrfield overall.

Markus Jokel

a. Chief Executive Officer, stated that the Board should develop contingency plans that could be

implemented if it seemed likely that the strong N$ would persist. In particular. Arrfield need not

renew the contracts that permit aviation fuel suppliers to operate from its airports. Arrfield would

then be free to create its own fuel sale business, buying fuel in bulk to replenish the storage tanks at

each of its airports in Norland and then selling it directly to airlines He stated that this would almost

certainly enhance Arrfield's share price

Romuald Marek reminded the Board that four of Arrfield's six airports are located in Norland and

that those airports charge for aeronautical and non-aeronautical services in N$.

Answer:

See the

answer below in

explanation.

Explanation:

Requirement : 1

A strong domestic currency in the Aviation business makes the business more profitable. It is evident

form interest rate parity that the exchange rate of currency appreciate as the interest rate fall. The

interest rate of the Norland is lower than other countries will make the N$ appreciated as compare

to the other countries.

A strong domestic currency is not always good for the Aviation business. It intrinsically involves the

use of foreign currency on regular basis. A strong NS may decrease the revenues of the Arrfield

because it will become costly for the airlines from abroad. The airlines may find airport of other

nearby countries with cheaper currency which will allow them cost savings with the use of cheaper

currency.

Requirement : 2

By starting aviation fail business by the Arrfield could increase the share price.

Suitability:

The aviation fuel business suits to Arrfield because of three reasons. 1- It will be taken by the market

as backward integration. This will reduce the risk of the Arrfield significantly. 2- The companies in

Norland with a strong currency are able to import cheaper fuel and offering discount to airlines. This

can be profitable business. 3- The criticism by the environmentalists may be managed by taking

corrective actions i.e. selling fuel at full price.

The Airfield could club the fuel charges into the landing, take off and terminal usage fee, this could

ease the process for the airlines could make the airports more popular. The Arrfield could also

manage the fuel inventory as per requirements because they have the schedule of the flights.

Acceptability:

The shareholders of the Arrfield will accept the proposal as it seems profitable and it may increase

the shar price of the Arrfield share because of the material information regarding starting a new

business line will give positive feed sign. The reputation risk arise from article a week before

regarding selling cheaper fuel may also be mitigated by taking over the business and corrective

actions may be taken.

The matter will not be appreciated by the companies they would wish to continue with Arrfield. They

must also be satisfied on termination of contract.

Feasibility:

Arrfield have 4 major airports (three hub and a spoke) in Norland. The hub airports are big and

planes are fueled with the underground pipelines and workforce work in close connection with the

fuel companies. The Arrfield have the infrastructure to start its business of aviation fuel.

Question 3

SIMULATION

Hello

I have attached a news article

Arrfield does not set the price for aviation fuel sold at our airports, but we do receive a percentage of

the revenues earned by the fuel companies.

I need your help to prepare for a Board meeting to discuss this matter Please write a paper covering

the following

* Firstly, explain the impact that the criticisms voiced by the environmental campaigners will have on

the frequent PESTEL analysis that Arrfield's Board conducts.

[sub-task (a) = 34%

* Secondly, evaluate the commercial logic of Arrfield's strategy of basing charges for non-

aeronautical services (such as fuel sales and retail activities) on percentages of the revenues

generated by the companies that operate at its airports

[sub-task (b) = 33%)

* Thirdly, recommend with reasons whether Arrfield should attempt to justify strategic decisions to

its shareholders when the commercial logic of those decisions is not immediately obvious

[sub-task (c) = 33%}

Thanks

Romuald Marek

Chief Finance Officer

Answer:

See the

answer below in

explanation.

Explanation:

Requirement 1

The criticism from the environmental campaigns for sale of cheap fuel at the Arrfield airports is not a

good sign but the prices of the fuel are not set by the Arrfield. In most of the countries the fuel prince

are regulated through Oil and Gas regulatory authorities. As the Arrfield airports are providing the

facilities to airlines to refill fuel at the airport which is necessary for the flying of the plane on

commission bases, it contribute a significant portion of profit of the Arrfield.

The environmental campaigners criticism is on the usage use of fuel which cause carbon emissions.

The Govt, of the Norland may set the price of the fuel in Norland and regulate the prices of the fuel

in Norland. After the criticism Govt, of Norland may think to not allowing the fuel companies to pass

the cheap fuel import to the airlines. This may be hostile of the Arrfiled business. Many airline may

choose the Norland for the flight operation due to gaining advantage of cheaper fuel refill.

As the airlines are buying more fuel which makes the plane heavier and burn more fuel which harm

to the environment is a great concern. This could lead to legal and environmental litigation and

penalties. The reputation risk is also here if corrective actions are not taken by Arrfield.

Requirement 2

As the Airfield also rely heavily on the non-aeronautical revenues to make profits and the it increase

from a substantial percentage in 2020 as to the preceding year. The fuel companies operate in Arrfied

airports which is intrinsic in the airport business. It will be difficult for the Arrfield to provide the fuel

by itself. It is worthwhile that the Arrfieid earning commission without involving the fuel operations.

As the Norland is being liked by the airlines for refueling its plane is good for the Arrfield to make

profit. Arrfield earn commission as much as the airline buy fuel from fuel companies. But by

decreasing the price of the fuel it is also worth mentioning that the Arrfield commission is also

remains at lower side.

There are three elements in the scenario: 1- Higher sale higher commission. 2- Sale at lower price

lower commission. 3-Reputational and environmental risk involved.

Requirement 3

The shareholders are major stakeholders of the company. They are key players have high amount of

power and high level of interest. The Arrfield must communicate true affairs of the business to its

shareholders. If the commercial logic of decision are not obvious then the poor understanding of the

affairs may lead to chaos. The managers are representative of the shareholders and should do

everything in the best interest of the shareholders. If they will make the decisions which are not

logically understandable then, the shareholders may lose their trust in the management.

The shareholders must not be justified to the shareholder if they are not commercially valuable.

Whether or not the decisions are profitable these may be communicated to shareholders which

represent true picture of the decisions breach of CIMA ethical principles.

Question 4

The Director of Finance, William Seaton, has stopped you in the corridor:

“Your report was really helpful, but the Board is still considering the implications of that email from

Jan Archibald at Fouce Oil. I need to make a more detailed report to the Board and I would like you to

draft it for me.

I know that we have owned and operated oil wells in the past, but that has always been with the

intention of finding a buyer who is prepared to pay a realistic price. We have chosen never to think

about the implications of keeping wells.

I need a report from you that covers the following issues:

The key political risks of retaining our interest in these oil wells, with particular emphasis on

high consequence, high likelihood risks.

A suitable response to each of your political risks.

An overview of how changes in the global economy and the demand for oil could affect the

decision to proceed.

The challenges associated with putting together a management team to take charge of the

production side of this proposed new

strategy.

I realise that this is a lot to ask of you, but I need you to move quickly because of the interest from

our biggest shareholder.”

Answer:

Complete

your answer and

submit.

Explanation:

Topic 3, Norland Telegraph (NEW)

Arrfield targeted by environmentalists

Environmental campaigners have criticized fuel suppliers at Norland's airports for selling aviation fuel

more cheaply than in other countries The N$ is strong, making it possible to import fuel more

cheaply Most suppliers are passing some of the savings on to airlines in order to boost revenues.

Airlines are responding by buying more when they refuel aircraft in Norland This means they need to

buy less fuel for the return flight from their destination Environmentalists are concerned because this

means that aircraft are carrying tonnes more fuel on their outward journeys and so consume more

fuel and cause more pollution in the process.

Airlines refer to this as "tankerage" because aircraft are effectively acting as fuel tankers on their

outbound journeys An airline spokesperson defended the practice, stating that it is a cheaper way to

fly even though fuel consumption is increased.

Question 5

The following email has been forwarded to you by William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Email from CFO of Fouce Oil

Hi

This email arrived last night. I need you to help me to think through the various implications of doing

what it suggests before I present it to the Board. I need you to focus on the following issues:

Would this proposal make sense from a strategic point of view?

If we did decide to go ahead, what would be the issues that we would have to consider with

respect to informing the stock market?

Could you please email me your thoughts within the next hour? I have to brief the Board later today.

Thanks

William

The email referred to can be found by clicking on the Reference Materials button.

Answer:

Complete

your answer and

submit.

Question 6

A month has passed since you submitted the report requested by William Seaton, Director of Finance

on the Board’s proposals.

You have received the following email:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Shale oil

Hi,

One of the geologists made a presentation to the Board, proposing that we investigate the extraction

of shale oil deposits. I have attached the slides that were used as the basis for this presentation.

I need you to work on a response to this document:

Firstly, what risks do you envisage in our entry to the shale oil business?

Secondly, what do you regard as the key factors that we should consider when deciding on

proceeding with this

proposal? Please justify your selection.

Thirdly, what factors should we take into account when deciding on which country or

countries to commence this

side of the business?

Finally, what are the challenges in creating a team of technical staff to lead our efforts in this

area?

William

The presentation slides can be found by clicking on the Reference Materials button.

Answer:

Complete

your answer and

submit.

Question 7

William Seaton, the Director of Finance stopped you in the corridor a week after the Head

Geologist’s announcement that reserves had been overstated:

“We informed the stock exchange that our reserves had been downgraded and our share price has

taken a solid hit. We need to work towards making sure that this is never repeated.

The Board is actively considering some changes that we hope will improve our forecasting system. I

am not convinced that the suggestions will work. Frankly, if we could predict the future with

certainty then I would have us stop looking for oil and start selling forecasts.

I would like you to work through the proposals that have been put forward and to recommend on

their adoption, with changes if you think it necessary. The issues that we are most seriously

considering are:

A suggestion that Big Data could be used to monitor oil prices. Do you think this would be a

sensible way to proceed?

A suggestion that we should update our reserves information on the company website in

real time. Do you think that would be an effective communication strategy?

Finally, we have considered a number of issues surrounding the motivation and inspiration of

our geologists. Two quite distinct schemes have been proposed. Firstly, some Board members

believe that our geologists should be rewarded in relation to the accuracy of their forecasts. Bonuses

will be paid on the basis of correct initial evaluation of wells. The bonus will increase if a well that

was initially identified as commercially viable goes into production and will decrease if a well that

was classified as viable is reclassified as unproductive.

Secondly, other members of the Board believe that there should be a greater degree of

accountability on the part of geologists. The incorrect classification of a well’s potential could be

treated as a disciplinary matter. Please provide a detailed analysis of EACH of those suggestions.”

Answer:

Complete

your answer and

submit.

Question 8

From: Martin Wills, Head Geologist

To: William Seaton, Director of Finance

Subject: Reserves

Hi William,

I have reviewed the situation with respect to our “probable” or “2P” reserves, as disclosed in our

latest annual report. I am sorry to say that we have to downgrade our figures with respect to

reserves. I am recommending that all extraction activities cease for the foreseeable future on the

North Atlantic and South Atlantic fields and that the proved reserves be downgraded from proved to

probable.

I have to stress that this is not attributable to any past error on the part of the geologists. The world

oil price has been depressed and the discovery of large deposits of shale oil in the USA suggests that

the oil price will not recover for some time. That means that some oil wells that were commercially

viable this time last year are no longer worth processing.

The oil remains under the rock and I have no doubt that we will restore operations in the long term.

We are by no means the only oil company to have been forced to take this action.

The one piece of good news is that the financial statements for the year ended 31 December 2014

have already been published. My understanding is that we do not have to withdraw them, so unless

you put an advertisement in the press, we can carry on quietly trying to sort this mess out.

I have my best people working on ways to extract oil from our wells more efficiently, so we may be

able to increase production over the next year or so.

Martin

Answer:

Complete

your answer and

submit.

Question 9

You have just received the following email:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Oil reserves

Hi,

This email arrived from the Head Geologist earlier today. I am concerned that many of our colleagues

understand very little other than rock formations and drilling reports. They certainly misunderstand

accounting issues. I have already had some very confused discussions with the other members of the

Board.

I need a very clear report from you that I can circulate to the other Board members. I am not

particularly interested in the technical accounting rules. I do not think that you necessarily require an

accounting standard to tell you that a particular disclosure is misleading.

I need your report to cover the following:

Should we make a public announcement of this information? I would like a clear indication

of the implications for our

relationship with our various stakeholders AND the ethical issues that you feel are relevant.

What are the implications for our share price? I would like your analysis to consider the

factors that will indicate how

our share price will change upon the announcement.

Thanks

William

The email referred to above can be found by clicking on the Reference Materials button.

Answer:

Complete

your answer and

submit.

Question 10

It is now three days since the start of the oil spillage crisis.

You have received the following email from William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Crisis management issues

Hi,

A quick update on the latest developments.

We have brought Block Associates in to lead the operations on dealing with the oil spill. It has

assigned one of its leading consultants to take charge of this for us. We have paid Block Associates an

annual retainer for many years, but we have never actually had to call on its services because we

have been able to contain any environmental problems using our own resources.

Using Block Associates is going to be expensive. It insists on being free to bring in whatever

equipment and personnel are required to resolve matters and to charge that on the basis of cost plus

25%. Our annual retainer is simply the cost of ensuring that it will respond on this basis if required.

We have had some murmurings of discontent already because our own engineers and geologists

have made significant progress in identifying the cause of the spillage and they believe that they are

capable of bringing it to a successful conclusion. They have suggested that it would be both quicker

and cheaper to leave them in charge, while retaining the option to bring in Block Associates at a later

date if they fail.

Firstly, what factors should we take into account in deciding whether to leave our own

experts in charge of this operation rather than using Block Associates?

Secondly, how should we manage our relationship with Block Associates if we decide that it

should be used?

Thirdly, two things: The Board is concerned that Slide’s engineers and geologists have

already become disillusioned by the decision to consider calling in Block Associates. We cannot

afford to lose their commitment or to see them decide to leave Slide in the longer term. I need you

to provide me with some ideas as to how we can motivate them to give their best performance for

the duration of this crisis AND to inspire them to remain in Slide’s employment after the crisis has

been resolved.

William

Answer:

Complete

your answer and

submit.

Question 11

Twelve hours have passed since you received the telephone call concerning the oil spillage.

You receive the following telephone call from William Seaton, Director of Finance:

“The press has got a hold of the story about the oil leak. Our share price has taken a major hit.

Indeed, Slide’s market capitalisation has fallen by a third since the stock exchange opened for

business. There is a lot of loose talk in the press about the knock-on effect of this crisis for Slide. It

has not escaped anybody’s notice that there are news teams showing injured wildlife. There is also a

great deal of footage being broadcast on the other sites around the world where we are revitalising

oil wells using the same technology that was in use at AZ40.

Our experts have only just arrived at the spillage site. While they were on the corporate jet they

emailed their initial thoughts, based on their understanding of what went wrong. Our engineers

anticipate a major operation to block the leak by pumping cement into the bore hole at a low

pressure. This will be expensive, but the cost will be less than one tenth of the reduction in our

market capitalisation.

I need an email from you:

Firstly, I need a clear explanation of the key risks that Slide now faces because of this crisis. I

am only interested in those with a high risk and high consequence and I need you to justify those

classifications because the Board will need to prioritise its responses.

Secondly, two related issues: I need you to explain why Slide’s share price has fallen to such

an extent AND to recommend, with reasons, whether we should release our costings of the repair

scheme at this time.

It goes without saying that I need this urgently.”

Answer:

Complete

your answer and

submit.

Question 12

From: Abdhulla Al- Waihabi, Regional Manager – Middle East – Slide

To: William Seaton, Director of Finance

Subject: Press article

Hi William,

I have just had a telephone call from a journalist at Business News to ask for a comment on a story

that it plans to run. As you know, we purchased oil wells in the AZ40 field last year in order to bring

them back to full production. We got the wells for a good price because the previous owner was

struggling to maintain oil pressure and it appeared that the recoverable reserves in that field were

close to exhaustion. Our experts worked out a plan to drill a hole and pump water into the well to

force more oil to the surface. That is a standard industry technique. Our geologists are the best in the

industry and so we are better than most at bringing wells back on stream.

It now appears that we are being blamed for an environmental catastrophe. Our pumping station is

only one kilometre from the sea and there are reports of oil coming to the surface along the coast

close to where we are operating. We have only just started operations and there are fears that we

have ruptured a rock formation with our high pressure pumping.

I have ordered an immediate halt to all pumping activity, but the oil could continue to bubble up for

years. The coastal area has some important coral reefs and there are fishermen who depend on

shellfish that can be found there.

I told the journalist that she would have to wait for a response from Slide’s Board. Business News is a

European newspaper, so any comment from you will carry more weight anyway.

I am sorry to be the bearer of such bad news.

Abdhulla

Answer:

Complete

your answer and

submit.

Question 13

You received a telephone call at home early in the morning, asking you to check your emails. The

following email was waiting for you:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Public relations crisis

Hi,

This email arrived from the Head of our Middle East office just now. They are a few hours ahead of

us, so he rang me at home to make sure that I had seen his message.

We have a few hours before the news article will be published, so I need to make the best use of that

time in order to limit the damage to Slide. Your priority is to protect our reputation because I have

already woken up the engineers and geologists and they are going to deal with the actual oil spillage.

I am not thinking too clearly, so I need you to provide some initial thoughts on the following:

Should we use our business relationship with Business News to have them withdraw the

story? We are a major advertiser and we spend millions with them every month. What are the

advantages and disadvantages?

Should we respond with the facts as we know them? All we know for certain is that there

have been reports of oil contamination in an area that has countless oil facilities nearby, and so we

could deny all responsibility, at least until our experts have had the chance to get there and to

investigate.

If we do decide to make a public announcement then we will need to have a plan in place.

We need to assemble a team to deal with the press. How should we structure our media response

team?

What are the key factors that the Board should consider when communicating with the

press? Explain why the factors that you have identified are important.

I realise that it is still very early, but I need your thoughts very quickly.

Thanks

William

The email referred to above can be found by clicking on the Reference Materials button.

Answer:

Complete

your answer and

submit.

Question 14

Three weeks have passed since you were informed that the relocation would definitely proceed.

You have received the following email from William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Detailed issues associated with the relocation

Hi,

Congratulations, you are now officially in charge of the transition team! I am confident that you will

do an excellent job and that it will be an opportunity to enhance your career.

I realise that the transition team is expected to reduce the pressure on the Board, but I have been

asked to keep an eye on things and to ensure that your team has everything that it needs. I won’t

interfere, but I will stay in touch.

There are a few matters that I think you should address as a matter of urgency.

Firstly, we need to have plans in place to ensure that our information systems are ready.

What changes will we have to make in order to best align the information system with the company’s

needs? I am not asking about hardware issues or the physical relocation, but the changes to the

information system itself.

Secondly, how might we make use of the data in our own records and external sources to

ensure that the new Head Office is managed as efficiently as possible? Remember that the present

Head Office is a large and complex operation in its own right and it costs a significant amount to run.

Thirdly, our relocation will create a number of challenges for our corporate treasury team. I

need you to identify the key challenges and suggest how they might be dealt with.

Finally, I would like you to identify the criteria against which the success or failure of your

team will be judged once the transition is complete. I need your recommendations to be relevant

and measurable.

William

Answer:

Complete

your answer and

submit.

Question 15

Six months have passed since you first heard of the possibility that Slide might relocate its Head

Office to the Middle East.

You have been called into William Seaton, the Director of Finance’s office:

“After lots of deliberation, the Board has reached a final decision on the Head Office move. It has

been decided that we will relocate to the Middle East.

I need you to draft a report on the following matters:

First of all, we need a strategy for the choice of country to which we are going to relocate. I

need you to think about the strategic decisions that will have to be taken so that we obtain the best

possible value from the relocation.

Secondly, we have to think about the change management issues with respect to Slide’s

senior managers. We have a good team of senior managers and Board members and we wish to see

them relocate with the company. I need your thoughts on this.

Thirdly, there will be significant change issues for the other staff members. We cannot justify

moving all of them to the Middle East, but we will be relying on them to ensure an orderly transition

from the current Head Office to the new one. They will be busy for several months, then most will be

made redundant. The rest will be offered new jobs with Slide because we will need a scaled down

administrative presence in Kayland. Again, I need your suggestions for this.

Finally, we need to put together a transition team to deal with the many administrative

issues that the move will create. I need you to suggest a clear job description for the transition team

that explains the main operational tasks required, so that the directors can be left free to focus on

the strategic management.”

Answer:

Complete

your answer and

submit.