cima CIMAPRA19 F03 1 Exam Questions

Questions for the CIMAPRA19 F03 1 were updated on : Feb 20 ,2026

Page 1 out of 27. Viewing questions 1-15 out of 391

Question 1

NNN is a company financed by both equity and debt. The directors of NNN wish to calculate a

valuation of the company's equity and at a recent board meeting discussed various methods of

business valuation.

Which THREE of the following are appropriate methods for the directors of NNN to use in this

instance?

- A. Total earnings multiplied by a suitable price-earnings ratio.

- B. Cash flow to all investors discounted at WACC less the value of debt.

- C. Cash flow to all investors discounted at WACC.

- D. Cash flow to equity discounted at the cost of equity less the value of debt.

- E. Cash flow to equity discounted at the cost of equity.

Answer:

A, B, E

Question 2

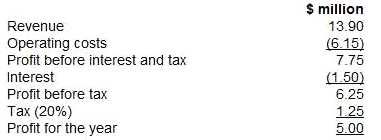

A financial services company reported the following results in its most recent accounting period:

The company has an objective to achieve 5% earnings growth each year. The directors are discussing

how this objective might be achieved next year.

Revenues have been flat over the last couple of years as the company has faced difficult trading

conditions. Revenue is expected to stay constant in the coming year and so the directors are

focussing efforts on reducing costs in an attempt to achieve earnings growth next year.

Interest costs will not change because the company's borrowings are subject to a fixed rate of

interest.

What operating profit margin will the company have to achieve next year in order to just achieve its

5% earnings growth objective'?

- A. 55.8%

- B. 60.0%

- C. 58.0%

- D. 58.5%

Answer:

C

Question 3

The Government of Eastland is concerned that competition within its private healthcare industry is

being distorted by the dominant position of the market leader, Delta Care. The Government has

instructed the industry regulator to investigate whether the industry is operating fairly in the

interests of patients.

Which of the following factors might the industry regulator review as part of their investigation?

Select ALL that apply.

- A. Profits amongst healthcare providers

- B. Each healthcare provider's market share

- C. Prices across the industry

- D. Medical treatment efficacy rates

- E. Industry entry barriers

Answer:

ABD

Question 4

Which TWO of the following statements about debt instruments are correct?

- A. A zero coupon will eliminate the tax shield effect on debt payments.

- B. Changes in corporation tax rates will have no effect on the tax shield of fixed rate debentures.

- C. The true cost of servicing debt instruments to the company is the post-tax cost of debt.

- D. If corporation tax rates rise, the tax shield effect on debenture interest will be reduced.

Answer:

AB

Question 5

An unlisted software development business is to be sold by its founders to a private equity house

following the initial development of the software. The business has not yet made a profit but

significant profits are expected for the next three years with only negligible profits thereafter. The

business owns the freehold of the property from which it operates. However, it is the industry norm

to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value

(CIV) method for this business?

- A. The business owns the freehold property from which it operates.

- B. Significant profits are forecast for the next three years with only negligible profits thereafter.

- C. The business has not yet made a profit.

- D. The CIV method cannot be applied to an unlisted company.

- E. The intellectual property representing the software development has not been included in the accounts.

Answer:

ACE

Question 6

WX, an advertising agency, has just completed the all-cash acquisition of a competitor, YZ. This was

seen by the market as a positive strategic move byWX.

Which THREE of the following will WX's shareholders expect the company's directors to prioritise

following the acquisition?

- A. The integration and retention of key employees of YZ.

- B. The development of a dividend policy to meet the expectations of the YZ's shareholders.

- C. The regulatory approval required to complete the acquisition.

- D. The retention of YZ's key customers.

- E. The realisation of anticipated post-acquisition synergies.

Answer:

ACE

Question 7

Which THREE of the following statements are true of a money market hedge?

- A. They offer roughly the same outcome as a forward contract.

- B. They leave the company exposed to currency risks.

- C. They may be a little more flexible in comparison to a forward contract.

- D. They are more complex than forward contracts.

- E. They are easy to set up.

Answer:

A, B, D

Question 8

F Co. is a large private company, the founder holds 60% of the company's share capital and her 2

children each hold 20% of the share capital.

The company requires a large amount of long-term finance to pursue expansion opportunities, the

finance is required within the next 3 months. The family has agreed that an Initial Public Offering

(IPO) should not be pursued at this time, because it would take up to 12 months to arrange.

The existing shareholders are currently considering raising the required finance from an established

Venture Capitalist in the form of debt and equity. The Venture Capitalist has agreed to provide the

required finance provided it can earn a return on investment of 25% per year. In addition, the

Venture Capitalist requires 60% of the equity capital, a directorship in the company and a veto on all

expenditure of a capital or revenue nature above a specified limit.

From the perspective of the family, which of the following are advantages of raising the required

finance from the Venture Capitalist?

Select all that apply.

- A. The cost of the finance under the Venture Capital investment.

- B. The changes in shareholding as a result of the Venture Capital investment.

- C. The veto on expenditure above a specified level of a revenue or capital nature.

- D. The speed with which the finance can be obtained.

- E. The experience of the Venture Capitalist with growing businesses.

Answer:

A, C

Question 9

Which THREE of the following statements are correct in respect of the issuance of debt securities.

- A. A bond issuer must appoint at least one market-maker to ensure that there is a liquid market in its traded bonds.

- B. The redemption yield on a corporate bond can be determined by calculating the internal rate of return based on the cash flows arising during the duration of the bond.

- C. Investors in traded bonds have an ownership (or equity stake) in the company which issued the bonds.

- D. A corporate entity coming to the bond market for the first time will find it easier to issue corporate bonds than to arrange a conventional term loan.

- E. Governments are the most frequent issuers of bonds and the proceeds are used to fund government expenditure or service the national debt.

Answer:

C, D, E

Question 10

A company is considering a divestment via either a management buyout (MBO) or sale to a private

equity purchaser. Which of the following is an argument in favour of the MBO from the viewpoint of

the original company?

- A. Better co-operation post divestment.

- B. Enhanced big data opportunities.

- C. Improved relationships with management buyout team in the event of a sale to the private equity purchaser.

- D. Higher price due to synergistic benefits.

Answer:

A

Question 11

ZZZ wishes to borrow at a floating rate and has been told that it can use swaps to reduce the

effective interest rate it pays. ZZZ can borrow floating at the risk-free rate + 1, and fixed at 10%.

Which of the following companies would be the most appropriate for ZZZ to enter into a swap with?

- A. Company DDA - it can borrow at risk-free rate + 1 Vz and fixed at 10.5%

- B. Company CCA - it can borrow at risk-free rate + Y% and fixed at 9%

- C. Company BBA - it can borrow floating at risk-free rate +VA and fixed at 12%

- D. Company AAB - it can borrow floating at risk-free rate + % and fixed at 9.5%

Answer:

B, C, D

Question 12

A company has stable earnings of S2 million and its shares are currently trading on a price earnings

multiple {PIE) of 10 times. It has10 million shares in issue.

The company is raising S4 million debt finance to fund an expansion of its existing business which is

forecast to increase annual earnings straight away by 25% and then remain at that level for the

foreseeable future. The corporation tax rate is 20%. It is expected that the P/E will reduce to 8 times

over the next year.

What is the most likely change in shareholder wealth resulting from this plan?

- A. Shareholder wealth will increase by $4 million.

- B. Shareholder wealth will increase by $3.2 million.

- C. Shareholder wealth will increase by $5 million

- D. No change in shareholder wealth.

Answer:

A

Question 13

G purchased a put option that grants the right to cap the interest on a loan at 10.0%. Simultaneously,

G sold a call option that grants the holder the benefits of any decrease if interest rates fall below

8.5%.

Which THREE possible s would be consistent with G's behavior?

- A. G is willing to risk the loss of savings from a fall in interest rates if that offsets the cost of limiting the cost of rises.

- B. G's strategy is to ensure that its interest rates lie between 8.5% and 10.0%.

- C. G is concerned that interest rates may rise above 10.0%.

- D. G is concerned that interest rates may rise above 8.5%.

- E. G is concerned that interest rates may fall below 10%.

Answer:

ABC

Question 14

A national rail operating company has made an offer to acquire a smaller competitor.

Which of the following pieces of information would be of most concern to the competition

authorities?

- A. After the acquisition, the board proposes to increase prices on some routes not serviced by other rail operators.

- B. After the acquisition, the board proposes to withdraw some of the less profitable services.

- C. The board informed a major institutional shareholder about the proposed acquisition before informing other shareholders.

- D. The acquisition is likely to result in significant redundancies of staff currently working for the smaller rail operator.

Answer:

A

Question 15

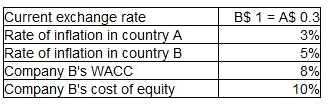

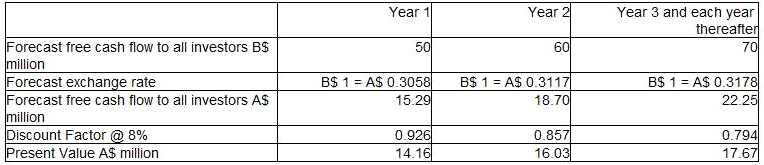

Company A operates in country A and uses currency AS. It is looking to acquire Company B which

operates in country B and uses currency B$. The following information is relevant:

The assistant accountant at Company A has prepared the following valuation of company B's equity,

however there are some errors in his calculations.

Value of Company B's equity = 14.16 + 16.03 + 17.67 = AS47.86 million

Company B has BS5 million of debt finance.

Which of the following THREE statements are true?

- A. The conversion into AS is incorrect as the assistant accountant should have divided by the exchange rate and not multiplied.

- B. Cash flow to all investors should be discounted at Company B's cost of equity of 10% rather than its WACC of 8%.

- C. The valuation is understated because forecast cash flows beyond year 3 have been ignored.

- D. The forecast exchange rates are incorrect as they show the BS strengthening and it should be weakening.

- E. The calculations show Company B's entity value, not its equity value.

Answer:

BCD