cima CIMAPRA19 F01 1 Exam Questions

Questions for the CIMAPRA19 F01 1 were updated on : Feb 20 ,2026

Page 1 out of 13. Viewing questions 1-15 out of 194

Question 1

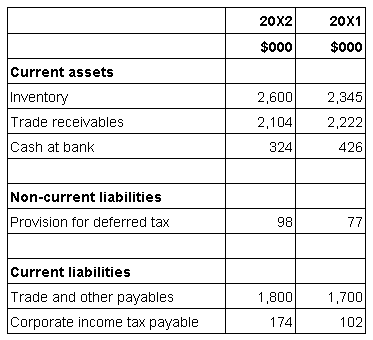

The following information is extracted from OO's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March

20X1.

The following information if included within OO's statement of profit or loss for the year ended 31

March 20X2:

Included within finance cost is $124,000 which relates to interest paid on a finance lease. 00 includes

finance lease interest within financing activities on its statement of cash flows.________________

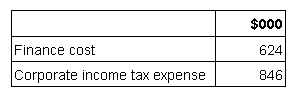

Within OO's statement of cash flow for the year ended 31 March 20X2 which figures should be

included to reflect the changes in working capital within the net cash flow from operating activities?

- A. Option A

- B. Option B

- C. Option C

- D. Option D

Answer:

C

Question 2

HOTSPOT

Answer:

Question 3

DRAG DROP

Answer

Answer:

Question 4

DRAG DROP

Answer

Answer:

Question 5

HOTSPOT

Answer:

Question 6

DRAG DROP

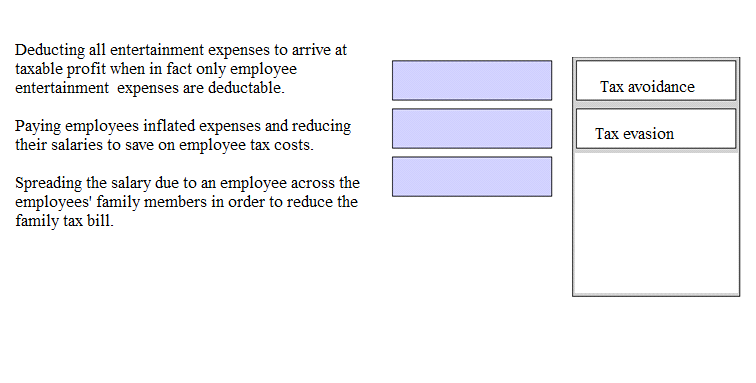

Identify whether the scenarios below are examples of tax evasion or tax avoidance, by placing either

tax evasion of tax avoidance against each one.

Answer:

Question 7

DRAG DROP

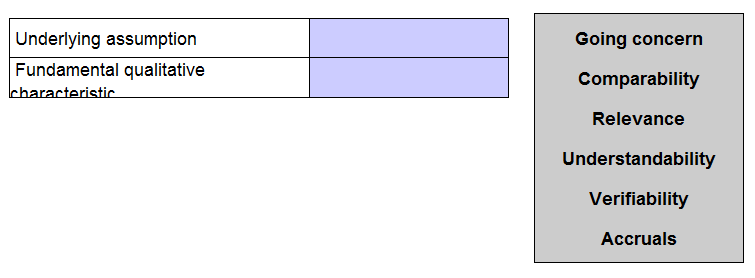

The Conceptual Framework for Financial Reporting issued by the International Accounting Standards

Board (known as the IASB's conceptual framework) includes one underlying assumption about the

preparation of financial statements and two fundamental qualitative characteristics for financial

information.

Identify the underlying assumption and one of the fundamental characteristics by placing one of the

options in each of the boxes below.

Answer:

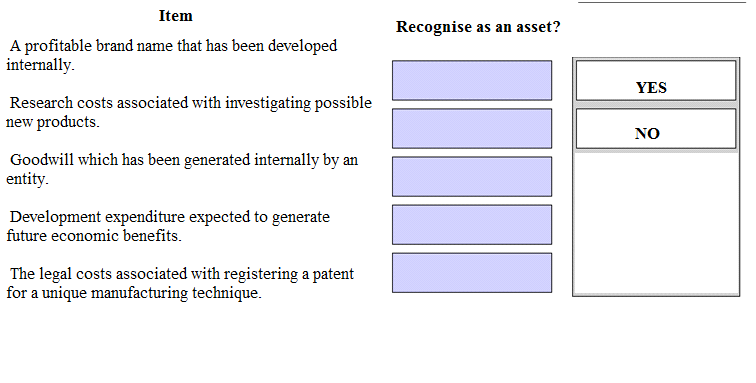

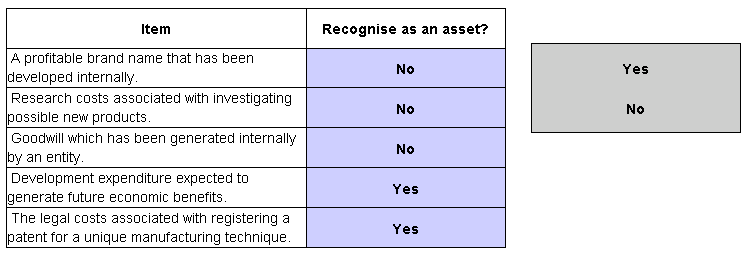

Question 8

DRAG DROP

Identify from the list below which items can be recognised as assets within the financial statements

of an entity in accordance with IAS 38 Intangible Assets. Place either yes or no as appropriate against

each item.

Answer

Answer:

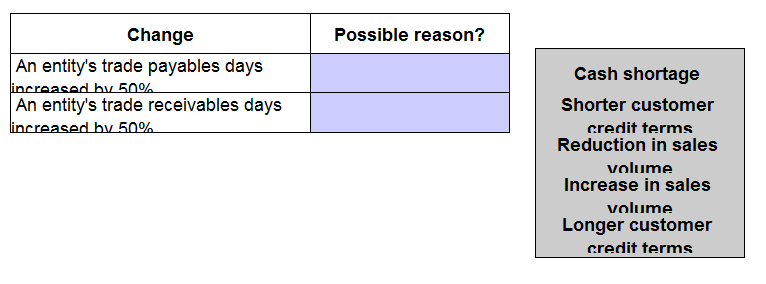

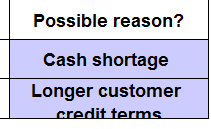

Question 9

DRAG DROP

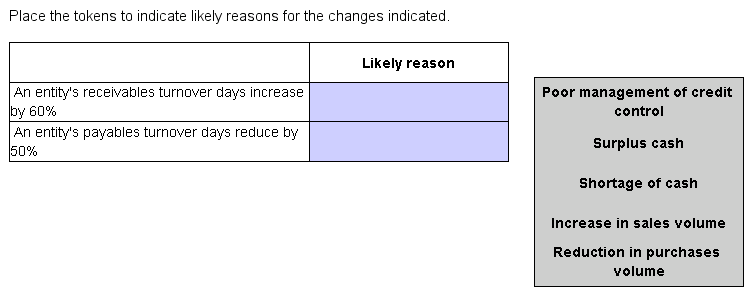

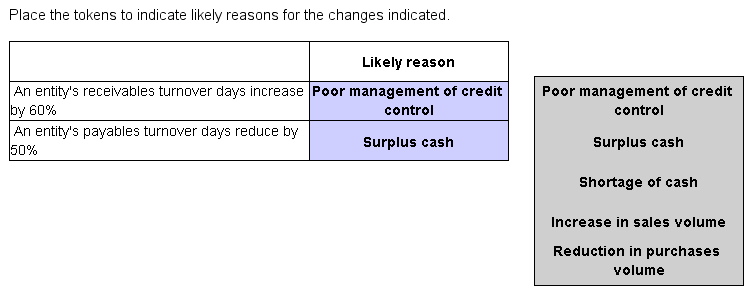

Indicate the possible reasons for the changes identified below to working capital ratios by placing the

appropriate reason against each change.

Answer:

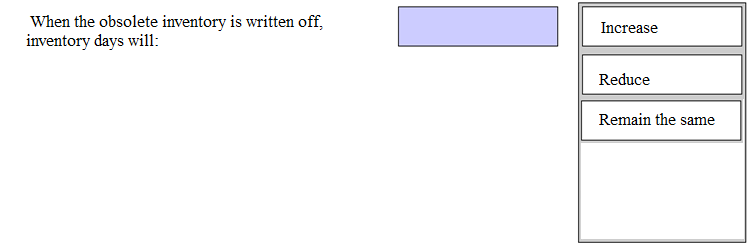

Question 10

DRAG DROP

An entity's inventory days are 45 days.

An entity ceased to manufacture a product in 20X4. Raw materials used solely in the manufacture of

that product are still held in inventory at 31 December 20X4.

Place the appropriate response below to show how inventory days will be affected if this raw

material inventory is written off as obsolete.

Answer:

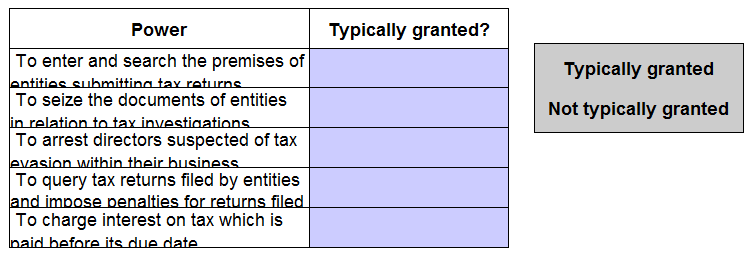

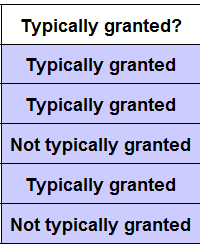

Question 11

DRAG DROP

Identify which of the following are powers that a government would typically grant it's tax authority

by placing the appropriate response beside each power.

Answer:

Question 12

DRAG DROP

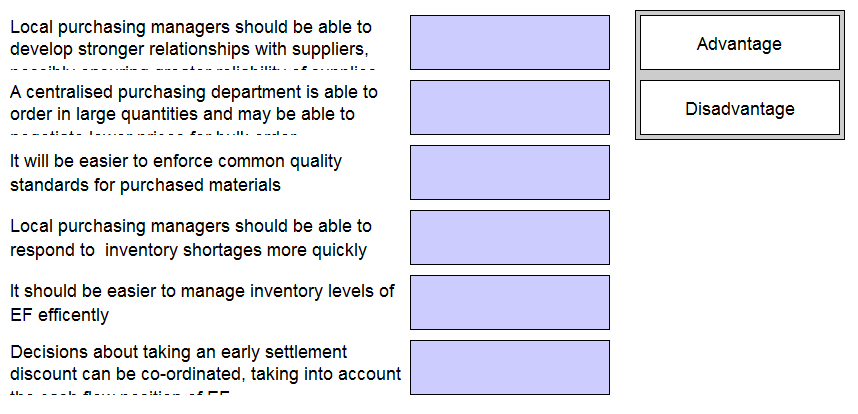

EF is a large manufacturing entity with several of its manufacturing sites in different locations.

Currently all of the sites have a local procurement department. EF's board are looking to implement

a centralized purchasing system.

Match the tokens according to whether you believe each statement is either an advantage or

disadvantage of implementing a centralized purchasing system for EF.

Answer:

Question 13

DRAG DROP

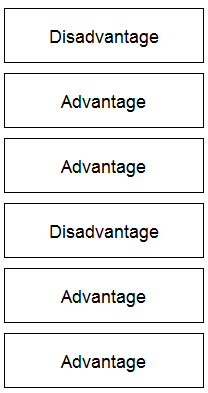

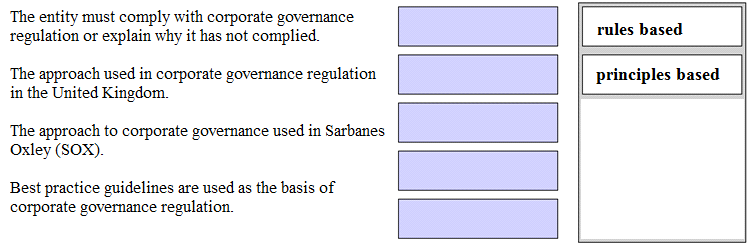

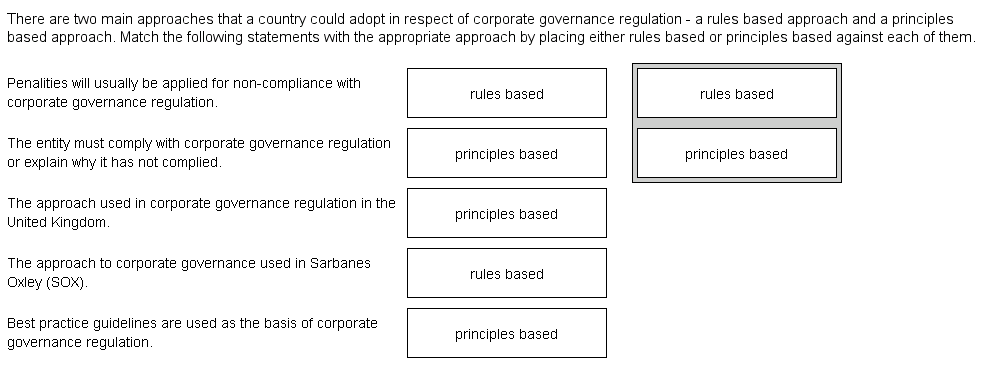

There are two main approaches that a country could adopt in respect of corporate governance

regulation - a rules based approach and a principles based approach. Match the following statements

with the appropriate approach by placing either rules based or principles based against each of

them.

Answer

Answer:

Question 14

DRAG DROP

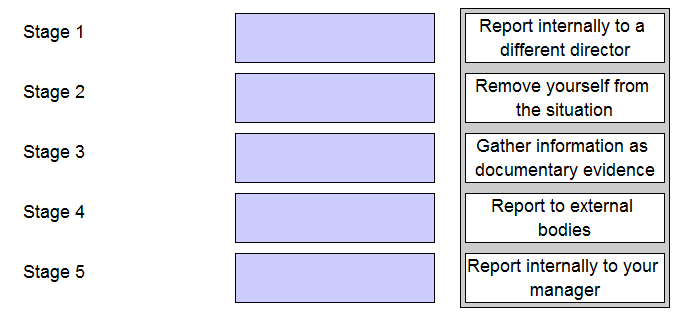

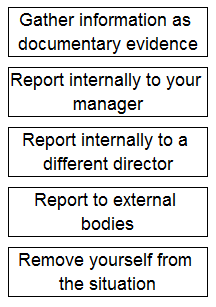

You work in the finance department of an entity. A director has approached you and asked you to

falsify sales invoices which would significantly inflate revenue. The CIMA Code of Ethics suggests that

you should deal with such an ethical dilemma by following a number of stages.

Place each of the stages identified below into chronological order.

Answer:

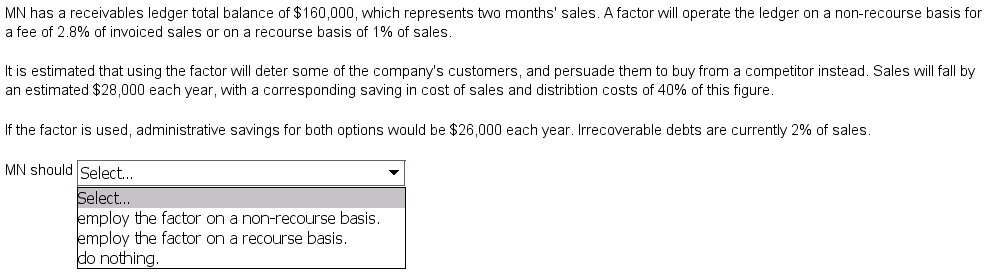

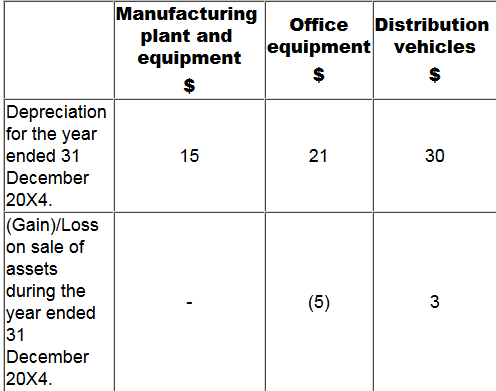

Question 15

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3.

AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is

expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered on the face of the Statement of profit or Loss for the year ended 31

December 20X4 in relation to Interest and Corporate income tax?

- A. Interest $25 Corporate income tax $(37)

- B. Interest $25 Corporate income tax $37

- C. Interest $50 Corporate income tax $(3)

- D. Interest $50 Corporate income tax $3

Answer:

A