cima CIMAPRA17 BA3 1 Exam Questions

Questions for the CIMAPRA17 BA3 1 were updated on : Feb 20 ,2026

Page 1 out of 27. Viewing questions 1-15 out of 393

Question 1

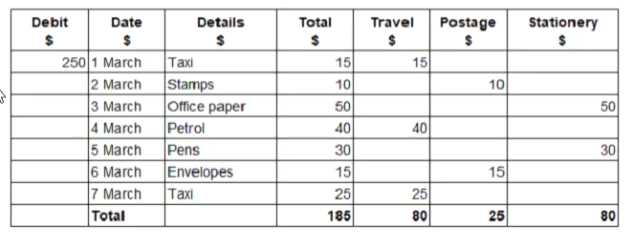

GH operates an imprest system for petty cash, maintaining a float of $250 The following petty cash

book extract is available for a week in March 20X6:

How much does GH need to transfer from the bank account at the end of this week In order to

maintain the imprest system?

- A. The total spend of $185

- B. The float total of $250.

- C. The total of the float and total spend of $435

- D. The difference between the float and total spend of $65

Answer:

A

Question 2

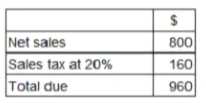

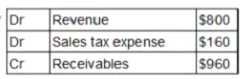

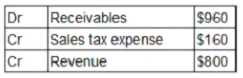

VWX is registered for sales tax in Country B A sales invoice to its mam customer shows the following

information:

What journal entry will WVX process to record this transaction in its nominal ledger?

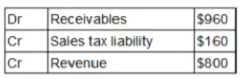

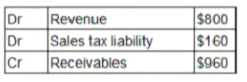

A)

B)

C)

D)

- A. Option A

- B. Option B

- C. Option C

- D. Option D

Answer:

B

Question 3

Which of the following would meet the definition of a liability in accordance with the Conceptual

Framework's definition?

- A. An amount due from a customer for goods dispatched two weeks ago

- B. An amount due to a supplier for goods to be purchased in one month's time

- C. An amount which was paid to a supplier in relation to a dispute

- D. An amount due to a supplier for goods purchased one month ago

Answer:

B

Question 4

In the year ended 31 December 20X1, XYZ receives an email confirming that a major customer has

gone into liquidation and will be unable to pay its suppliers.

Which of the following is the impact of adjusting for this event?

- A. Profits increase and allowance increases.

- B. Receivables decrease and allowance increases

- C. Receivables unchanged and profits decrease

- D. Receivables decrease and profits decrease

Answer:

D

Question 5

CORRECT TEXT

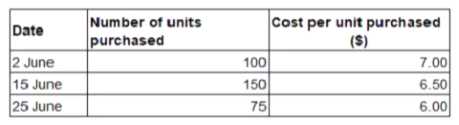

At 1 June 20X9 XY has opening inventory of 80 units at a cost of $7.60 each XY purchases the

following units during the month of June:

During June 20X9, XY sold 250 units at a price of $15.00 each XY uses the first in. first out (FIFO)

method of inventory valuation What is the value of XYs closing inventory at 30 June 20X9? Give your

answer to the nearest $.

Answer:

$970

Question 6

The Finance Director of EFG company has made the following statements regarding the recording of

expenditure relating to the entity's property, plant and equipment (PPE) in the nominal ledger.

Which THREE of the following statements are true?

- A. The annual depreciation charge reduces EFG's profit for the year.

- B. The cost of insurance for the factory is debited to the PPE asset account.

- C. The loss on the disposal of PPE reduces EFG's profit for the year

- D. The cost of repainting the office is credited to the repairs expense account

- E. The loss on the disposal of PPE is recorded in a liability account

- F. The annual depreciation charge reduces the carrying value of PPE

Answer:

A. C, F

Question 7

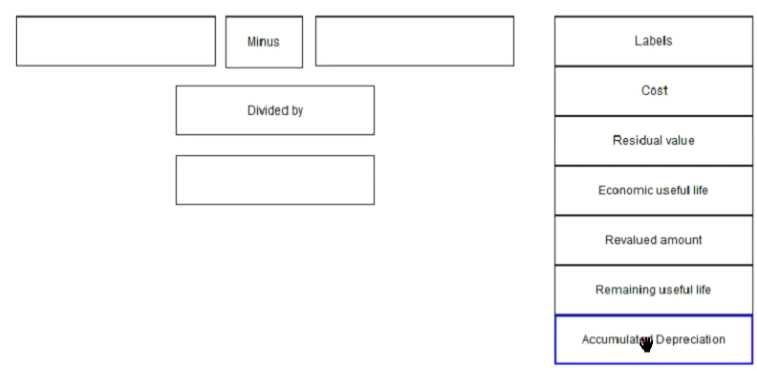

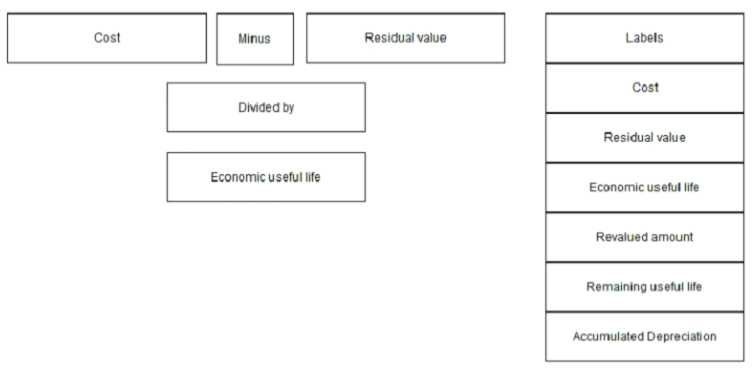

DRAG DROP

Complete the formula for depreciation of a revalued asset.

Place the relevant labels in the correct positions below.

Answer

Answer:

$1450

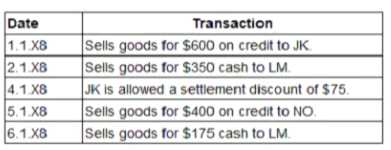

Question 8

CORRECT TEXT

GH has the following transactions for the week of January 20X8:

GH is not registered for sales tax

What is the total of the sales day book for this week? Give your answer to the nearest whole

number:

Answer:

$1450

Question 9

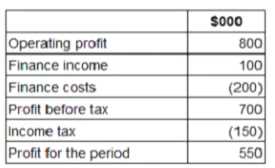

GG has the following statement of profit or loss extract for the year ended 31 December 20X3

What is the interest cover for GG for the year ended 31 December 20X3?

- A. 2.8 times

- B. 4.0 times.

- C. 4.5 times

- D. 3.5 times

Answer:

B

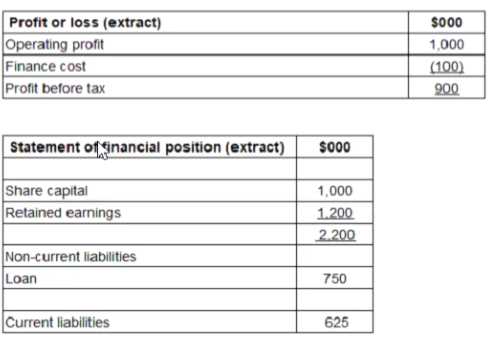

Question 10

The following are extracts from CD's financial statements for the year to 31 December 20X2:

What is the return on capital employed percentage (ROCE) for CD for the year ended 31 December

20X2?

- A. 28 0%

- B. 30 5%

- C. 33.9%

- D. 25.2%

Answer:

C

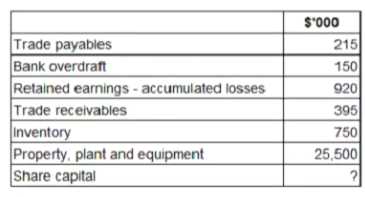

Question 11

CORRECT TEXT

The balances of the trial balance of CDE for the year ended 31 May 20X4 is as follows

What must the balance on the share capital account be at 31 May 20X4 if the trial balance is to

balance? Give your answer in $’000

Answer:

$26280

Question 12

Which TWO of the following are transactions that would be recorded in the sales ledger control

account?

- A. Irrecoverable debts

- B. Cash received from credit customers

- C. Cash sales.

- D. Cash paid to credit suppliers.

- E. Credit purchases.

Answer:

A, B

Question 13

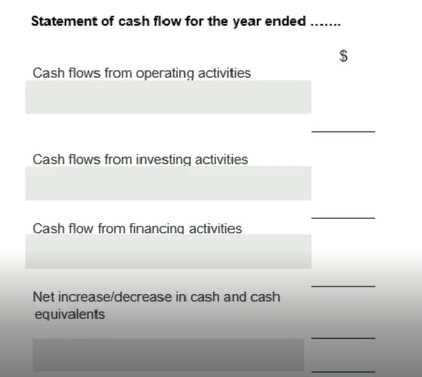

HOTSPOT

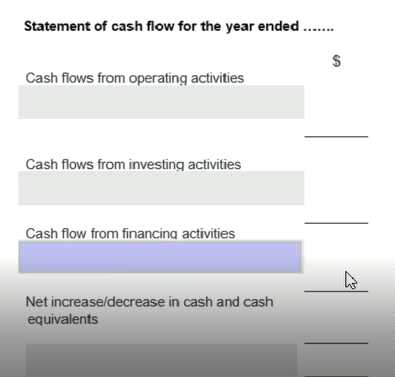

In which section of the statement of cash flow would cash from share issues be included? Select one

of the following

Statement of cash How for the year ended.......

Answer:

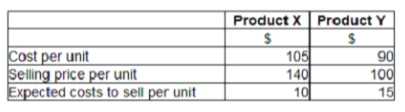

Question 14

AB sells two products ,X and Y. The following information was available at AB’s year-end, 31

December 20X6:

At 31 December 20X6 AB held 800 units of Product X and 400 units of Product Y

What is the value that will be included in inventories in AB's statement of financial position as at 31

December 20X6?

- A. $120,000

- B. 5134,000

- C. $138,000

- D. $118,000

Answer:

D

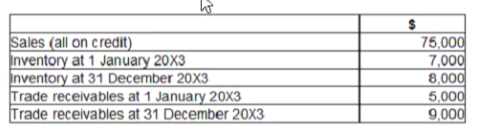

Question 15

MM does not maintain complete accounting records. The following information is available for the

year ended 31 December 20X3:

The mark up on items sold by MM is 20%.

Which THREE of the following statements are true?

- A. Opening receivables is a debit balance

- B. Using mark-up means the profit is based on selling price

- C. Opening receivables is a credit balance.

- D. Opening inventory is a credit balance

- E. Using mark-up means the profit is based on cost

- F. Opening inventory is a debit balance.

Answer:

B, C, D