aiwmi CCRA-L2 Exam Questions

Questions for the CCRA-L2 were updated on : Feb 20 ,2026

Page 1 out of 6. Viewing questions 1-15 out of 84

Question 1

__________Strategy consists of buying a bond with maturity longer than the investment horizon (for

investor)

or buying a long-maturity bond with short-term funding through repo (for speculator).

- A. Barbell, Ladder and Butterfly

- B. Yield Spread Anticipation

- C. Rate Anticipation with Maturity Mismatch

- D. Riding the yield curve

Answer:

D

Question 2

Provisioning Coverage Ratio (PCR) is essentially the ratio of provisioning to ______ and indicates the

extent

of funds a bank has kept aside to cover loan losses.

- A. total loan portfolio

- B. gross non-performing assets

- C. total assets

Answer:

B

Question 3

Step up upon feature will lead to

- A. no change as step is not linked to issuers rating

- B. positive basis because the bond holder is compensated

- C. negative basis given that the bondholder is not compensated

- D. Will lead to a change only if there is a linkage to the issuer’s rating

Answer:

B

Question 4

The _______ cycle is the length of time between the company’s outflow on raw materials and the

manufacturing expenses and the inflow of cash from the sale of goods.

- A. Cash flow mismatch

- B. Money

- C. Running

- D. Operating

Answer:

D

Question 5

Which of the following factor is considered while undertaking management evaluation?

- A. All of the other options

- B. Corporate Strategy

- C. Performance of group concerns

- D. Past track record

Answer:

D

Question 6

Short term rates are determined by____________

- A. All of the other options

- B. Liquidity position caused by seasonal demand supply for credit

- C. Foreign portfolio investment inflows and outflows

- D. Bunching of tax and government payments

Answer:

B

Question 7

Which of the following is false in case of credit enhancements?

- A. It reduces the default risk of the borrowing entity for the lender, thereby deteriorating the overall credit worthiness of the borrower

- B. Credit enhancement could be implicit or explicit

- C. Credit enhancement is a mechanism whereby external cash flows is extended by an entity which has a stringer credit profile, so that it benefits the fund raising entity

Answer:

A

Question 8

Which of the following is NOT a conceptual definition of credit risk on which credit models are

based?

- A. Default Mode Paradigm

- B. Value-at-Risk paradigm

- C. Mark-to-Market Paradigm

Answer:

B

Question 9

Statement 1: The Yields on the MBS PTCs are normally higher than the yields on the corporate bonds

of similar ratings.

Statement 2: The reason for difference in yields on the corporate bonds and similarly rated PTCs is on

account of the optionality in the PTC, the unfamiliarity of the structure and uncertainties in respect of

legal and structural issues.

Which of the above statements is correct?

- A. None of the statements

- B. Both the statements

- C. Only Statement 2 is correct

- D. Only Statement 1 is correct

Answer:

D

Question 10

Stand by letter of credits are typically taken as credit enhancement for___________

- A. Commercial Paper

- B. Long term Bond issues

- C. Long term debenture issues

- D. Bank debt

Answer:

D

Question 11

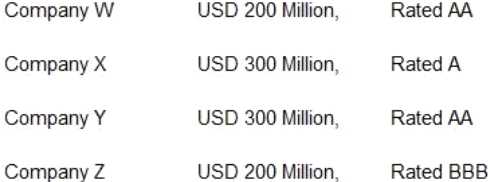

Bank A has an imaginary portfolio of USD 1000 Million distributed towards following four entities:

Bank A is stipulated to maintain a capital adequacy ratio of 11% on its risk weighted assets. It is being

stipulated that the ratings for all the four entities is expected to be downgraded by 1 notch each.

Estimate the amount of new capital required for Bank A?

- A. USD 93.5 Million

- B. USD 38.5 Million

- C. USD 55 Million

- D. USD 850 Million

Answer:

B

Question 12

Which of the following is not an importance of the sovereign rating?

A: To arrive at cost of lending to a country

B: To set lower floor for the rating of the corporate and banks of the countries on international scale.

C: For determining the risk levels for international investment portfolios

- A. Only A and C

- B. Only B

- C. Only A and B

- D. None of the three

Answer:

B

Question 13

In a weakening economy, which of the following is least accurate?

- A. Interest costs go up and create refunding risk for those who have bonds maturing which need to be rolled over.

- B. Interest costs go up and create rate risk for have bonds maturing which need to be rolled over.

- C. None of the other options.

- D. Interest costs go up and create funding risk for those who have borowing plans lined up.

Answer:

D

Question 14

Based on the Moody’s KMV model which of the following is not correct?

A: Growth variables are important for default analysis. rapid growth will lead to lower probability of

default and rapid decline will lead to higher probability of default.

B: Activity ratios are relevant for default analysis. A large stock of inventories relative to sales will

lead to a higher probability of default.

- A. Only Statement A is correct

- B. Both the statements are correct

- C. None of the statements is correct

- D. Only Statement B is correct

Answer:

D

Question 15

Awesome Mobile Ltd is a leading mobile seller who manufactures mobile phone under own brand

Awesome.

Which of the following is the biggest business risk for Awesome?

- A. Technology Risk

- B. Branding risk

- C. Raw material price risk

- D. Competition

Answer:

C