ahip AHM-520 Exam Questions

Questions for the AHM-520 were updated on : Feb 20 ,2026

Page 1 out of 15. Viewing questions 1-15 out of 215

Question 1

The Jade Health Plan used a profitability index (PI) to rank the following capital proposals:

Proposal

PI

A

0.45

B

1.05

This information indicates that, of these two projects, Jade would most likely select:

- A. Proposal A, and the PI indicates that the net present value (NPV) for this project is less than zero

- B. Proposal A, and the PI indicates that the net present value (NPV) for this project is greater than zero

- C. Proposal B, and the PI indicates that the net present value (NPV) for this project is less than zero

- D. Proposal B, and the PI indicates that the net present value (NPV) for this project is greater than zero

Answer:

C

Question 2

The following statements are about the capital budgeting technique known as the payback method.

Select the answer choice containing the correct statement:

- A. The main benefit of the payback method is that it is simple to use.

- B. The payback method measures the profitability of a given capital project.

- C. The payback method considers the time value of money.

- D. The payback method states a proposed project’s cash flow in terms of present value for the life of the entire project.

Answer:

A

Question 3

An investor deposited $1,000 in an interest-bearing account today. That sum will accumulate to

$1,200 two years from now. One true statement about this transaction is that:

- A. The process by which the original $1,000 deposit grows to $1,200 is known as compounding

- B. $1,200 is the present value of the $1,000 deposit

- C. The $200 increase in the deposit’s value is its incremental cash flow

- D. The $200 difference between the original deposit and the accumulated value of the deposit is known as the deposit’s discount

Answer:

A

Question 4

A health plan may experience negative working capital whenever healthcare expenses generated by

plan members exceed the premium income the health plan receives.

Ways in which a health plan can manage the volatility in claims payments, and therefore reduce the

risk of negative working capital, include:

1. Accurately estimating incurred but not reported (IBNR) claims

2. Using capitation contracts for provider reimbursement

- A. Both 1 and 2

- B. 1 only

- C. 2 only

- D. Neither 1 nor 2

Answer:

A

Question 5

The Amethyst Health Plan uses a budgeting approach that requires each line of business within

Amethyst’s operation to justify its continued operation. Amethyst begins with the premise that no

resources will be allocated for the following period unless each dollar to be spent is justified and is

shown to be within departmental plans and corporate goals and objectives. The budgeting approach

used by Amethyst is known as:

- A. Bottom-up budgeting

- B. Top-down budgeting

- C. Zero-based budgeting

- D. Master budgeting

Answer:

C

Question 6

For a given healthcare product, the Magnolia Health Plan has a premium of $80 PMPM and a unit

variable cost of $30 PMPM. Fixed costs for this product are $30,000 per month. Magnolia can

correctly calculate the break-even point for this product to be:

- A. 274 members

- B. 375 members

- C. 600 members

- D. 1,000 members

Answer:

C

Question 7

Costs that can be defined by behavior are most commonly classified as fixed costs, variable costs and

semi-variable costs. Examples of fixed costs include:

- A. Rent, insurance expense, and depreciation on computer equipment

- B. Rent, claims processing costs, and selling expenses

- C. Claims processing costs, telephone expense, and depreciation on computer equipment

- D. Premium processing, rent, and selling expenses

Answer:

A

Question 8

In order to achieve its goal of improved customer service, the Evergreen Health Plan will add three

new customer service representatives to its existing staff, install a new switching station, and install

additional phone lines. In this situation, the cost that would be classified as a sunk cost, rather than a

differential cost, is the expense associated with:

- A. Adding new customer service representatives

- B. Maintaining the existing staff

- C. Installing a new switching station

- D. Installing additional phone lines

Answer:

B

Question 9

Ways in which a company can increase its return on investment (ROI) include:

1. Reducing expenses to increase operating income

2. Increasing controllable investment

- A. Both 1 and 2

- B. 1 only

- C. 2 only

- D. Neither 1 nor 2

Answer:

B

Question 10

Variance analysis is the study of the difference between expected results and actual results.

Variances can be positive or negative. A positive variance is typically considered:

- A. favorable for both expenses and revenues

- B. favorable for expenses, but unfavorable for revenues

- C. favorable for revenues, but unfavorable for expenses

- D. unfavorable for both expenses and revenues

Answer:

C

Question 11

The goal of the investment department at the Wayfarer Health Plan is to maximize investment

return. The investment department executes investments on time and at a low cost. However, these

transactions often result in low returns or risks that are deemed too high for Wayfarer. With regard to

effectiveness and efficiency, it is correct to say that Wayfarer’s investment department is:

- A. both effective and efficient

- B. efficient, but not effective

- C. effective, but not efficient

- D. neither effective nor efficient

Answer:

B

Question 12

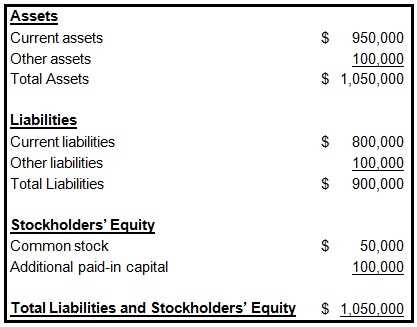

The following information was presented on one of the financial statements prepared by the Rouge

health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

- A. Cash by its reported claims only

- B. Cash by its reported claims and its incurred but not reported claims (IBNR)

- C. Reported claims by its cash

- D. Reported claims and its incurred but not reported claims (IBNR) by its cash

Answer:

B

Question 13

The following information relates to the Hardcastle Health Plan for the month of June:

Incurred claims (paid and IBNR) equal $100,000

Earned premiums equal $120,000

Paid claims, excluding IBNR, equal $80,000

Total health plan expenses equal $300,000

This information indicates that Hardcastle’s medical loss ratio (MLR) for the month of June was

approximately equal to:

- A. 40%

- B. 67%

- C. 83%

- D. 120%

Answer:

C

Question 14

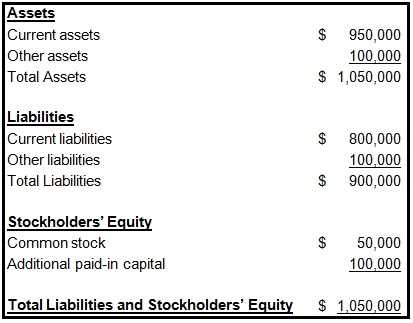

The following information was presented on one of the financial statements prepared by the Rouge

Health Plan as of December 31, 1998:

Rouge’s current ratio at the end of 1998 was approximately equal to:

- A. 0.84

- B. 1.06

- C. 1.19

- D. 1.31

Answer:

C

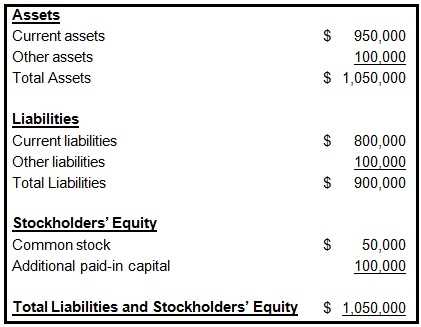

Question 15

The following information was presented on one of the financial statements prepared by the Rouge

Health Plan as of December 31, 1998:

This type of financial statement is called:

- A. A balance sheet

- B. An income statement

- C. A statement of owners’ equity

- D. A cash flow statement

Answer:

C