aafm GLO CWM LVL 1 Exam Questions

Questions for the GLO CWM LVL 1 were updated on : Feb 20 ,2026

Page 1 out of 71. Viewing questions 1-15 out of 1057

Question 1

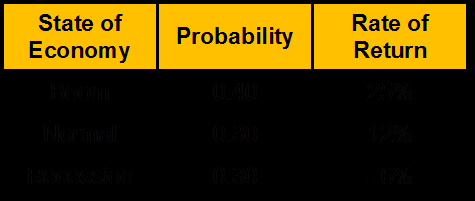

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

- A. 11.40%

- B. 12.90%

- C. 10.50%

- D. 13.50%

Answer:

B

Question 2

A portfolio manager is considering buying Rs. 1,00,000 worth of Treasury bills for Rs. 96,211 versus

Rs. 100,000 worth of commercial paper for Rs. 95,897. Both securities will mature in nine months.

How much additional return will the commercial paper generate over the Treasury bills?

- A. 0.45%

- B. 0.27%

- C. 0.35%

- D. 0.21%

Answer:

A

Question 3

Smt. Rajalakshmi owns a house property at Adyar in Chennai. The municipal value of the property is

Rs. 5,00,000, fair rent is Rs. 4,20,000 and standard rent is Rs. 4,80,000. The property was let-out for

Rs. 50,000 p.m. up to December 2010. Thereafter, the tenant vacated the property and Smt.

Rajalakshmi used the house for self-occupation. Rent for the months of November and December

2010 could not be realized in spite of the owner's efforts. She paid municipal Texas @12% during the

year. She had paid interest of Rs.25,000 during the year for amount borrowed for repairs for the

house property. Compute her income from house property for the A.Y. 2012-13.

- A. Rs 281500

- B. Rs 275500

- C. Rs 269000

- D. Rs 265400

Answer:

C

Question 4

Calculate the death claim amount if the assured dies in the 25th year of the policy. Money back

policy with SA of Rs. 50000. Term is 25 years. Survival benefits of 10% each paid at the end of 5th ,

10th, 15th, and 20th years. Accrued bonus of Rs. 500 per thousand of SA.Interim bonus of Rs. 75 per

1000 of SA.

- A. 50000

- B. 57500

- C. 100000

- D. 107500

Answer:

D

Question 5

Shruti has invested Rs. 12000 for 8 years at the rate of interest of 6%. What amount she will get after

8 years if amount is compounding annually for the first 5 years and semi annually for the last 3 years?

- A. 19803.43

- B. 19174.92

- C. 18976.24

- D. 19203.46

Answer:

B

Question 6

Vinod is projecting an income stream providing Rs. 2,000/- for first 3 months, Rs. 3,200 for next 2

months, Rs. 4,500 for next 1 month, Rs. 3,700 for next 6months and Rs. 800 for 2 months thereafter.

Please calculate the Present Value of this cash stream if rate of interest is 9%

- A. 24465.92

- B. 25817.12

- C. 24,513.72

- D. 23478.68

Answer:

C

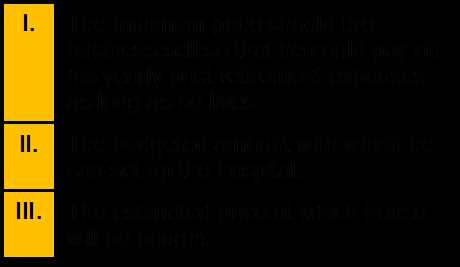

Question 7

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year

2012-13.

- A. Rs. 2 lakh

- B. Rs. 9.50 lakh

- C. Rs. 17 lakh

- D. Rs. 9 lakh

Answer:

A

Question 8

Mr. Bose runs his Handicrafts business. His net proceeds after deducting both the business expenses

and living expenses are Rs. 6,00,000 p.a, which will increase at the rate of 5%. He is a bachelor and

don’t intend to start any family in future either. Since he don’t have any family obligations, he wants

to sell off his business after ten years and buy a home in foothills of Himachal.

He expects to sell the business for a good amount and put 40% of the proceeds in buying the house

and setting up a retirement corpus with the rest of amount to pay off his post retirement expenses.

He is philanthropic by nature and thus want to save the net revenues from his business to form a

charitable hospital for poor people living in Himachal. His current living expenses are Rs. 4,00,000 p.a

which will increase in line with inflation. Inflation rate is 3% and interest rate prevailing is 6%.

As a CWM you are required to calculate:

- A. Business: Rs 4,61,82,645, House: Rs 2,77,09,587, Hospital: Rs 97,17,000

- B. Business: Rs 3,07,88,430, House: Rs 1,23,15,372, Hospital: Rs 97,17,000

- C. Business: Rs 2,77,09,587, House: Rs 2,77,09,587, Hospital: Rs 80,97,653

- D. Business: Rs 3,69,46,116, House: Rs 1,84,73,058, Hospital: Rs 97,17,000

Answer:

B

Question 9

Vinod joined on 01/01/90 in ABC Ltd. and retired on 01/01/2007.Employee paid leave encashment of

Rs. 4,00,000/-. His last drawn salary is Rs. 25000/-. His last 10 months average salary is 23500/-. He

availed 150 days leave during the service. What will be his taxable leave salary amount?

- A. 4,00,000

- B. 2,35,000

- C. 2,82,000

- D. 1,65,000

Answer:

D

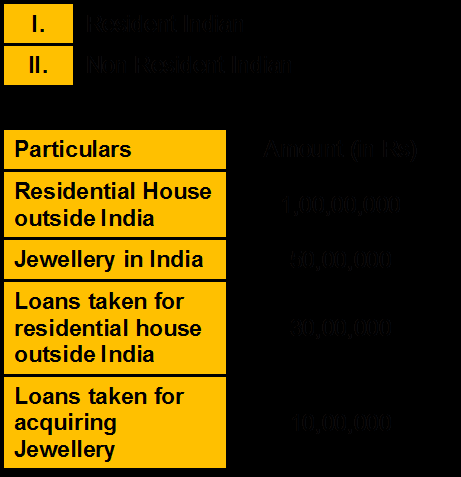

Question 10

From the following information of assets assets and liabilities, the taxable wealth for:

- A. Rs 1,10,00,000 & Rs 40,00,000 respectively

- B. Rs 1,00,00,000 & Rs 40,00,000 respectively

- C. Rs 1,10,00,000 & Rs 50,00,000 respectively

- D. Rs 70,00,000 & Rs 40,00,000 respectively

Answer:

A

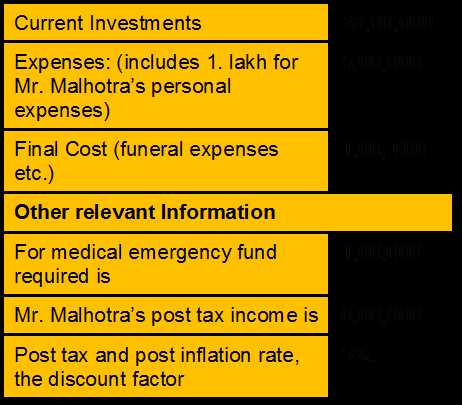

Question 11

Mr. Malhotra and Mrs.Malhotra aged 50 and 45 years respectively, both have a life expectancy of 35

years.

You have following information

Calculate the adequate insurance required based on need based approach.

- A. 65 lakhs

- B. 60 lakhs

- C. 54 lakhs

- D. 44 lakhs

Answer:

C

Question 12

Which of the following is/are the desirable contents of a will?

- A. I ,II and III

- B. II , III and IV

- C. I, III and IV

- D. All of these

Answer:

B

Question 13

Mr. Ravi aged 28 years is a marketing professional who earns a salary of Rs. 50000 p.m. He is very

concerned about his retirement expenses. For the same he has started saving Rs. 6000 p.m. regularly

in a bank fixed deposit paying an interest of 9.5% p.a. since the age of 23.

At the age of 38, he is thinking of buying a house on his retirement which is 25 years away.

He has estimated that the price of the house at his retirement will be Rs. 4000000. Calculate the

amount of retirement corpus accumulated by him and the extra savings he has to make at the age of

38 in order to purchase the house? (Inflation rate = 3% p.a.)

- A. Rs. 32617751 &Rs. 9281

- B. Rs. 20036777 &Rs. 6870

- C. Rs. 32617751 &Rs. 3281

- D. Rs. 20036777 &Rs. 3500

Answer:

C

Question 14

Ram purchased a house in Mumbai in March 2000 for Rs.3,50,000. In April,2011 he entered into an

agreement to sell the property to Shyam for a consideration of Rs.19,75,000 and received earnest

money of Rs.5,00,000. As per the terms of the agreement, the balance payment was to be made

within 30 days of the agreement. If the intending purchaser does not make the payment within 30

days, the earnest money would be forfeited. As Shyam could not make the payment within the

stipulated time the amount of Rs.5,00,000 was forfeited by Ram.

Which of the following statement is correct in respect of the above problem? [CII-12-13: 852,11-12:

785,10-11:711,84-85: 125]

- A. Rs.500000 will be taxable as short term capital gain

- B. Rs.500000 will be taxable as long term capital gain

- C. Rs.150000 will be taxable under some other head other sources

- D. Rs.150000 is not liable to tax

Answer:

C

Question 15

Mr. Sushil, is 35 years old and working as a physician in a private hospital. He will retire at the age of

60. He is saving Rs. 30,000/- p.a. at the end of every year for past 5 years and will continue to save

the same up to his retirement @ 7% p.a. His annual expenditure is Rs. 3,00,000/-. Life expectancy of

Mr. Sushil is 75 years. On retirement, rate of interest is expected to be 6%. Calculate on retirement

how much he can spend per annum if he leaves Rs. 5,00,000/- as estate for next generation?

- A. Rs. 2,47,375

- B. Rs. 2,51,823

- C. Rs. 2,54,997

- D. Rs. 2,42,320

Answer:

C