aafm CTEP Exam Questions

Questions for the CTEP were updated on : Feb 20 ,2026

Page 1 out of 32. Viewing questions 1-15 out of 472

Question 1

Assuming that Mr. Nitin leaves everything to surviving spouse. Shortly, thereafter Mrs. Shikha dies

same year leaving an estate of $5 million. Find the value of estate available for children. Assume only

for this question that there is no estate tax exemption amount and the funeral expenses are not paid

out of the estate amount.

- A. $2.98 million

- B. $5 million

- C. $3 million

- D. None of the above

Answer:

C

Question 2

The Client wants to find out the value of estate that his spouse and each of their children would

receive assuming he dies today.

- A. $2,804,035

- B. $2,774,035

- C. $2,757,333

- D. $2,772,702

Answer:

B

Question 3

Mr. Nitin wants to know the value of estate (before taxation) as on 1st January 2013.

- A. $10,363,509

- B. $10,513,509

- C. $10,280,000

- D. None of the above

Answer:

A

Question 4

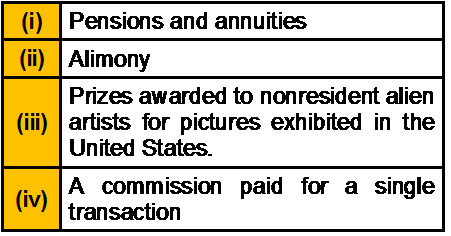

Which of the following income comes under “FDAP Income”?

- A. Both (i) and (ii)

- B. All except (iv)

- C. All except (iii)

- D. All of the above

Answer:

D

Question 5

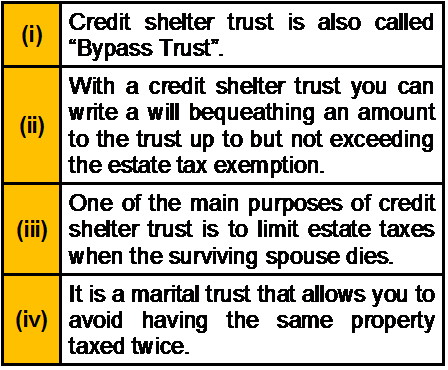

Which of the following statement(s) about Credit Shelter Trust is/are correct?

- A. Only (ii) and (iii)

- B. Both (i) and (iv)

- C. All except (i)

- D. All of the above

Answer:

D

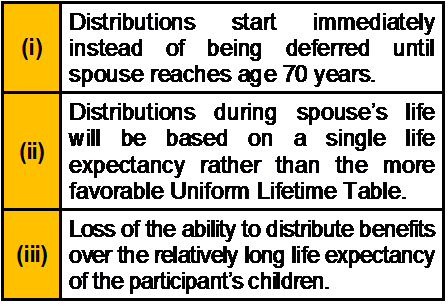

Question 6

You are a Trust and Estate Planner. Mr. Keith is your client. He is 45 years old. He asks you that in case

he wants to leave assets for the life benefit of his spouse, but ultimately have the funds pass to his

children by a prior marriage he should create ______________________. He further asks you to

explain disadvantages of such arrangement. You tell him that the disadvantages of the arrangement

are ____________ of the given options.

- A. Living Trust; All of the above

- B. Living Trust; All except (iii)

- C. QTIP Trust; All except (ii)

- D. QTIP Trust; All except (i)

Answer:

D

Question 7

You are a Trust and Estate Planner. Mr. Sumit, your client comes out you with the following data and

wants to know for which the years he is resident or not.

He left UK on 10th March 2008 to work full-time abroad and visited UK for:

74 days in the tax year 2008–09; 98 days in the tax year 2009–10; 92 days in the tax year 2010–11; 79

days in the tax year 2011–12

Assume the following only for this question:-

320 days in the remainder of the tax year 2008-2009;365 days in the tax year 2009-10; 366 days in

the tax year 2010–11; 366 days in the tax year 2011-2012.

Your reply to Mr. Sumit is –“For the year 2009-2010 you are ______________, for year 2010- 2011

you are _______ and for the year 2011-2012 you are ______________”

- A. Non-Resident; Non-Resident; Non-Resident

- B. Non-Resident; Resident; Non-Resident

- C. Resident; Non Resident; Non-Resident

- D. Resident; Resident; Resident

Answer:

B

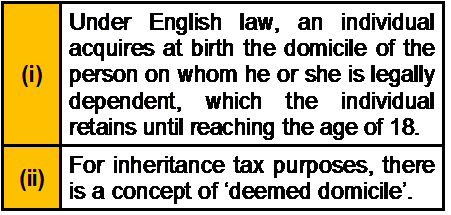

Question 8

Mr. Alen is born in UK and his father was non-UK domiciled soldier of foreign nation serving in the

UK. Mr. Neil father was non-UK domiciled and he was adopted by a UK domiciled father. The status of

domicile for Allen and Neil respectively is ______________ and ______________. Mrs. Suzan is a

woman with a domicile of origin outside the UK who married a man domiciled within the UK in

January 1970. Mrs. Kathy,a US national married a man on 1st January 1974 domiciled in UK. The

status of domicile for Mrs. Suzan and Mrs. Kathy respectively is _____________ and

______________.

- A. UK domicile; Non-UK domicile; UK domicile; US domicile

- B. Non-UK domicile; UK domicile; UK domicile; Either US or UK domicile

- C. UK domicile; UK domicile; Non-UK domicile; UK domicile

- D. Non-UK domicile; Non-UK domicile; UK domicile; Either US or UK domicile

Answer:

B

Question 9

The defined period for fraudulent transfers under the Bankruptcy Code was formerly

____________prior to the debtor’s filing for bankruptcy. This period was ____________ by the

Bankruptcy Abuse Prevention and Consumer Protection Act of ___________.Transfers to self-settled

trusts may be recaptured if made within _________ of the debtor’s filing for bankruptcy if the

transfer in trust was made with the intent to hinder, delay or defraud present or future creditors.

- A. One year ; Extended to two years; 2005; 10 years

- B. Two years; Reduced by one year; 2005; 10 years

- C. One year; Extended to two years; 2008; 15 years

- D. Two years; Reduced by one year; 2008; 15 years

Answer:

A

Question 10

Section______ of the Administration of Muslim Law (Amendment) Act 2008 (Act 29 2008)

substituted "______years" with "_____ years" in section ______(4) and (5) of this Act with effect

from 1st March 2009.

- A. 18, 15, 16, 96

- B. 19, 16, 18, 98

- C. 19, 16, 18, 96

- D. 19, 15, 16, 98

Answer:

C

Question 11

In US the exemption amount for Alternative Minimum Tax in the case of estate or trust is _________.

The same in the case of married individuals filing a joint return and surviving spouses is

______________.

- A. $80,800; $51,900

- B. $22,500; $80,800

- C. $51,900; $22,500

- D. $40,400; $51,900

Answer:

B

Question 12

Which of the following statement(s) is/are correct?

- A. Both (i) and (ii)

- B. Neither (i) nor (ii)

- C. Only (i)

- D. Only (ii)

Answer:

D

Question 13

__________________ is used to show what Inheritance tax is due when someone has died and

_________________ is used to show what Inheritance tax is due from lifetime events.

- A. IHT 100; IHT 400

- B. IHT 200; IHT 300

- C. IHT 400; IHT 100

- D. IHT 300; IHT 200

Answer:

C

Question 14

In UK, savings interest is taxed at _____________. But if you’re on a low income, you may be able to

get the interest tax-free or get_______ of the tax repaid.

- A. 10%; Half

- B. 20%; Half

- C. 10%; One third

- D. 20%; One third

Answer:

B

Question 15

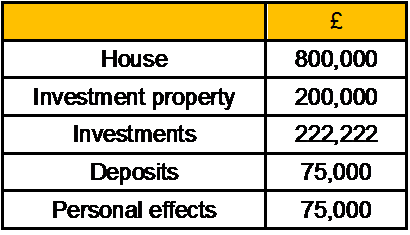

Mrs. Brown is a widow with four children. Her husband left his estate completely to her on his death.

When Mrs. Brown dies, her estate on death includes:-

The funeral expenses of Mrs. Brown amount upto £1,900. Find out the amount of estate that would

be distributable to each beneficiary.

- A. £108,048

- B. £108,333

- C. £107,858

- D. £205,548

Answer:

A